NO.PZ202108100100000105

问题如下:

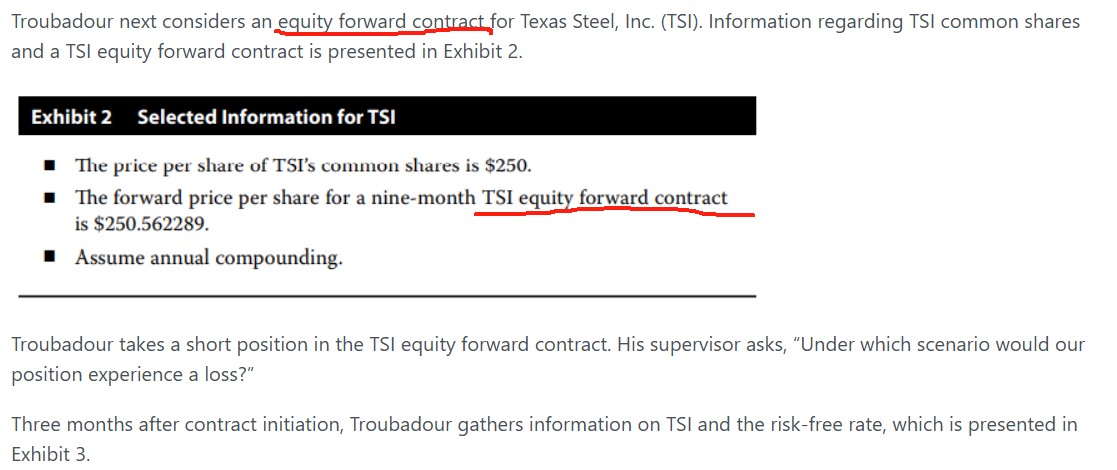

Based on Exhibits 2 and 3, and assuming annual compounding, the per share

value of Troubadour’s short position in the TSI forward contract three months

after contract initiation is closest to:

选项:

A.$1.6549.

$5.1561.

$6.6549.

解释:

C is correct.

The no-arbitrage price of the forward contract, three months after

contract initiation, is

F0.25 = FV0.25(S0.25 + CC0.25 – CB0.25)

F0.25 = [$245 + 0 – $1.50 / (1 + 0.00325)(0.5-0,25) ] (1 + 0.00325)(0.75-0.25) =

$243.8966.

herefore, from the perspective of the long, the value of the TSI forward contract is

V0.25= PV0.25 [F0.25 – F0]

V0.25= ($243.8966 – $250.562289)/(1 + 0.00325)(0.75-0.25) = –$6.6549.

Because Troubadour is short the TSI forward contract, the value of his position

is a gain of $6.6549.

中文解析:

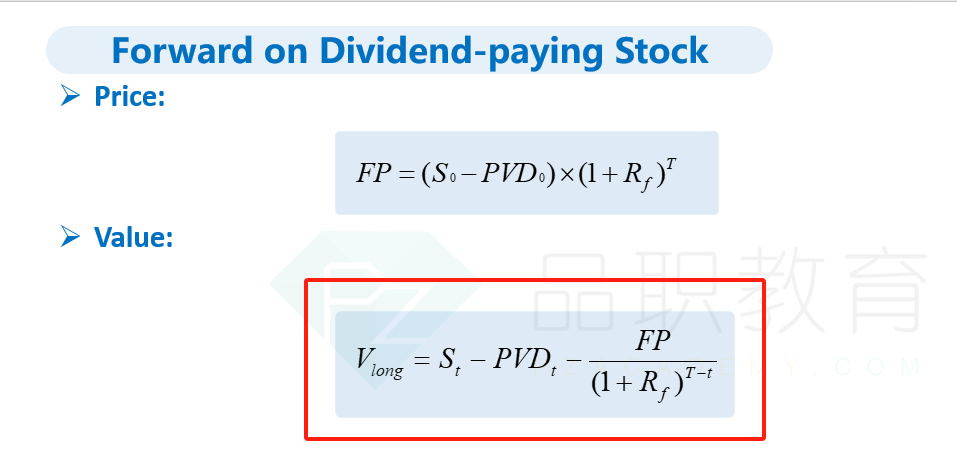

本题考察的是t时刻求value,有重新定价法和画图法两种方法。

上述求解过程为重新定价法,即先求t=3时刻的远期合约价格F,然后和F作差后折现至t时刻即可。

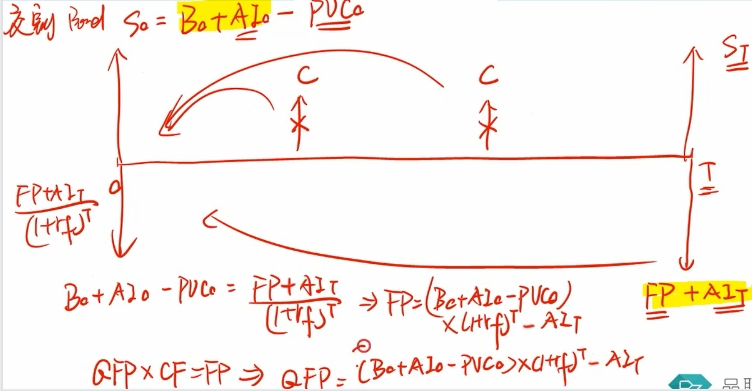

如果使用画图法,与课程讲法一致:假设是long position,向上箭头表收到,向下的箭头表支出,二者相减即为所求的value。对应本题需要注意的是short头寸,因此最后求得结果需要取负号即可。

具体计算过程如下图:

按照上课的公式如何对应