NO.PZ2023010903000005

问题如下:

Hans Smith, an Albright portfolio manager, makes the following notes after examining these funds:

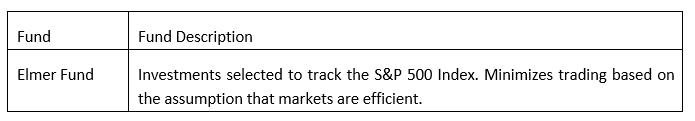

Note 4 Of the four funds, the Elmer Fund is most likely to appeal to investors who want to minimize fees and believe that the market is efficient.

Note 5 Adding investment-grade bonds to the Elmer Fund will decrease the portfolio’s short-term risk.

Which of the notes regarding the Elmer Fund is correct?

选项:

A. Only Note 4

Only Note 5

Both Note 4 and Note 5

解释:

For passively managed portfolios, management fees are typically low because of lower direct costs of research and portfolio management relative to actively managed portfolios. Therefore, Note 4 is correct.

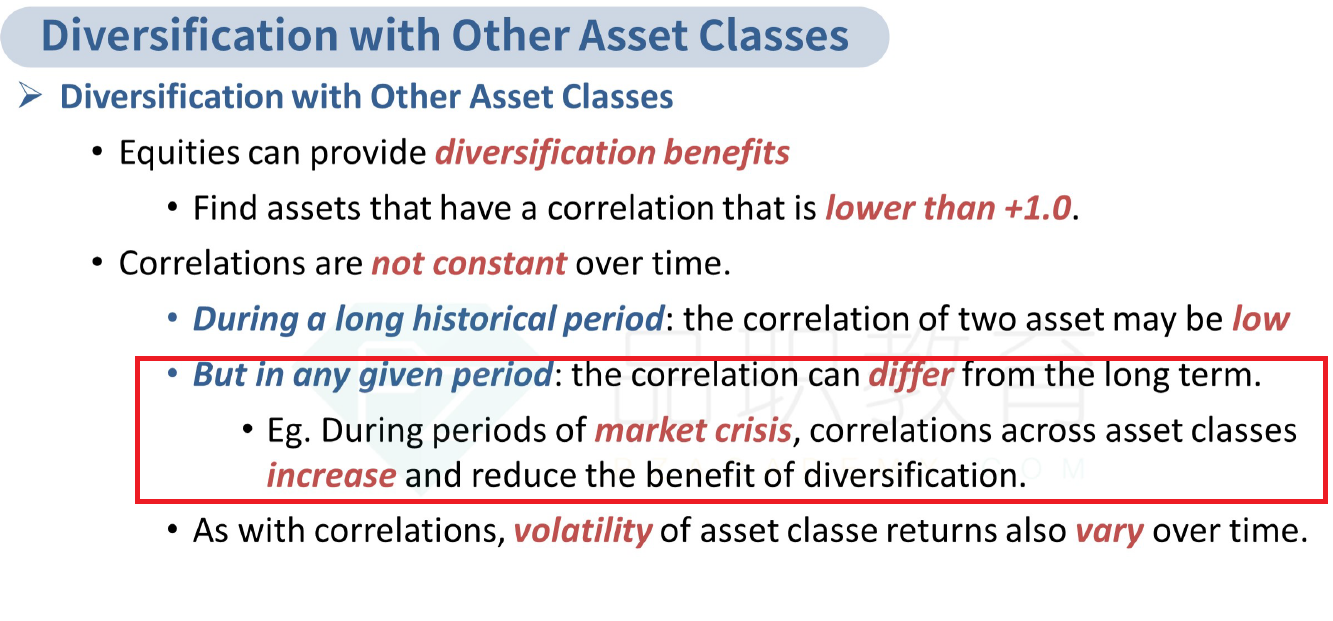

Note 5 is incorrect because the predictability of correlations is uncertain.

在短期,无论加入长期债券还是短期债券,都不一定降低风险。

在长期,无论加入长期债券还是短期债券,都可以降低风险。

我看其他老师回答有这个,请问怎么理解啊