NO.PZ202403051000000202

问题如下:

In his statement about modern theories of the term structure, Aguero is most likely correct about:

选项:

A.interest rate volatility.

B.the structure of the interest rate models.

C.convergence of short-term and long-term interest rates.

解释:

-

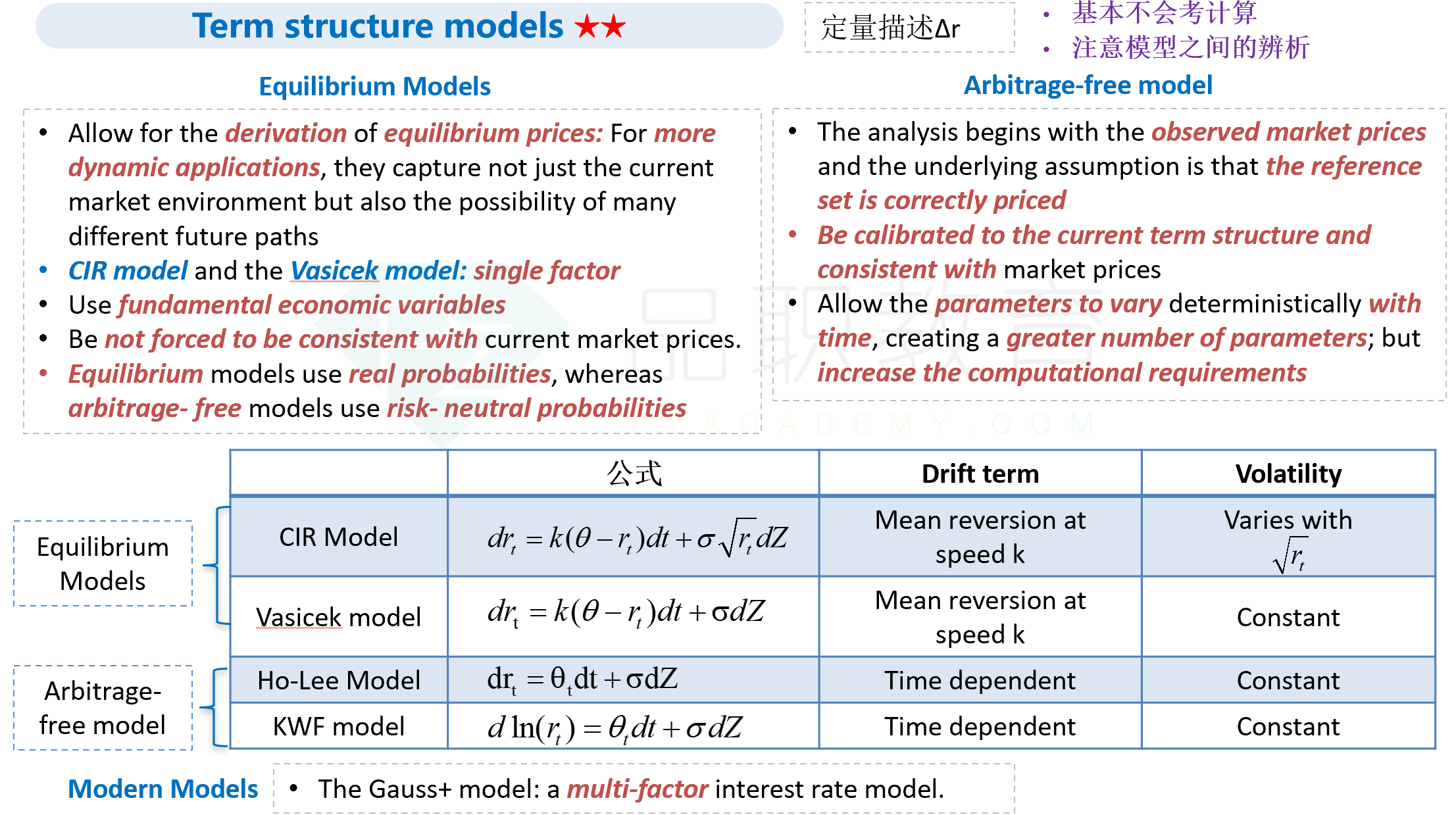

A is incorrect. Aguero is incorrect about interest rate volatility, which is constant in the case of the Vasicek and Ho–Le models. For the CIR model, volatility increases with the level of interest rates, but it does not for the Ho–Lee model, as stated.

-

B is correct. Aguero is correct that the structure of the three models (CIR, Vasicek, and Ho–Lee) are the same in that they have a drift term and a stochastic term. The composition of the drift term for the CIR and Vasicek models is the same, while it is different for the Ho–Lee model. The stochastic terms are different for the three models.

-

C is incorrect. Both the CIR and Vasicek models are mean reverting in that they assume short- term interest rates converge to the long-term interest rate over time. The Ho–Lee model does not make this assumption.

这个题是现在的考点吗?好像没有学过