NO.PZ2025041201000028

问题如下:

The board of directors of a global bank is aiming to strengthen the bank's approach to managing money laundering and financing of terrorism (ML/FT) risks. The bank's risk management team is tasked with suggesting appropriate measures that adhere to industry best practices. Which of the following actions would be the most suitable for the team to recommend?

选项:

A.Instruct business units, as the first line of defense, to implement enhanced due diligence procedures for high - risk customers, including regular reviews of their account activities.

B.Set a high threshold for transaction amounts and only review transactions above this amount for ML/FT risks, to optimize resource allocation.

C.Assume that customers with low - value transactions pose negligible ML/FT risks and exempt them from routine screening processes.

D.Assign the IT department the sole responsibility for developing and maintaining the bank's ML/FT risk monitoring systems.

解释:

Option A:Business units, as the first line of defense, should indeed implement enhanced due diligence for high - risk customers, including regular reviews of account activities. This is in line with best practices for identifying and managing ML/FT risks. Thus, this option is correct.

Option B:Setting a high threshold and only reviewing transactions above it for ML/FT risks is incorrect. ML/FT risks can occur in transactions of all sizes, and comprehensive monitoring is necessary. So, this option is incorrect.

Option C:Assuming that low - value transaction customers pose negligible ML/FT risks and exempting them from screening is wrong. ML/FT risks are not solely determined by transaction value, and all customers should be subject to appropriate screening. So, this option is incorrect.

Option D:Assigning the IT department sole responsibility for developing and maintaining ML/FT risk monitoring systems is inappropriate. Managing ML/FT risk requires a coordinated effort from multiple departments, including compliance, risk management, and business units. So, this option is incorrect.

选项 A:作为第一道防线的业务部门,确实应该对高风险客户实施强化尽职调查程序,包括定期审查他们的账户活动。这符合识别和管理反洗钱 / 反恐怖融资(ML/FT)风险的最佳实践。所以该选项正确。

选项 B:设置高交易金额门槛,仅对超过该金额的交易审查 ML/FT 风险是错误的。ML/FT 风险可能存在于各种规模的交易中,全面监测是必要的。所以该选项错误。

选项 C:认为低价值交易客户的 ML/FT 风险可忽略不计并免除其常规筛查程序是错误的。ML/FT 风险并非仅由交易价值决定,所有客户都应接受适当筛查。所以该选项错误。

选项 D:将开发和维护银行 ML/FT 风险监测系统的唯一责任交给 IT 部门是不合适的。管理 ML/FT 风险需要多个部门(包括合规、风险管理和业务部门)的协同努力。所以该选项错误。

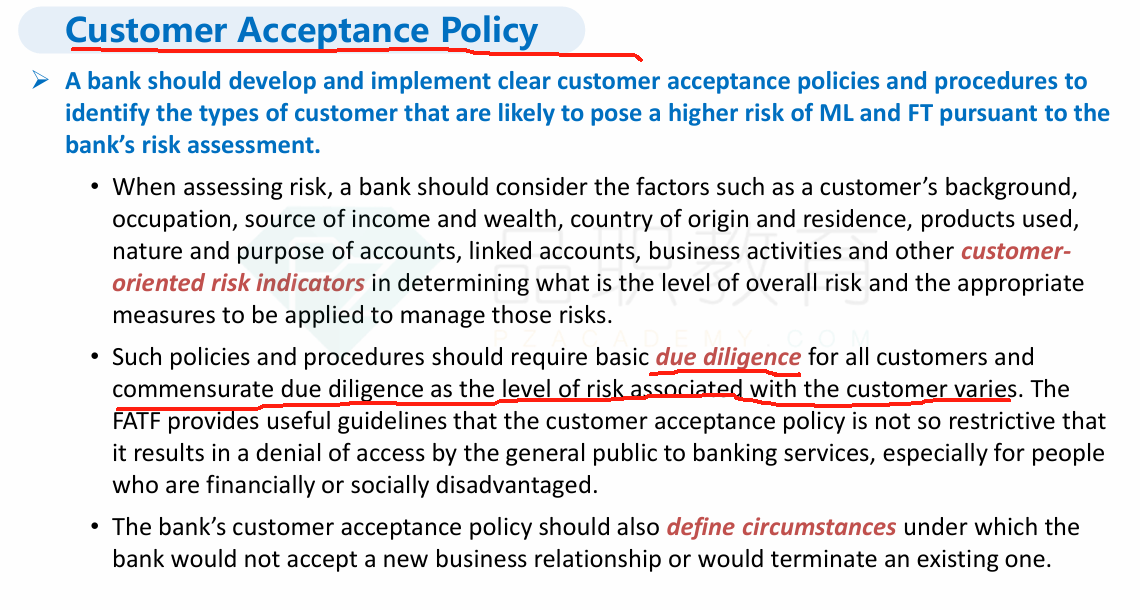

implement enhanced due diligence procedures for high - risk customers 这不是合规的工作吗(第二道防线),为什么变成business unit的工作了?