NO.PZ2024101001000083

问题如下:

Question An analyst gathers the following information (in $ millions):

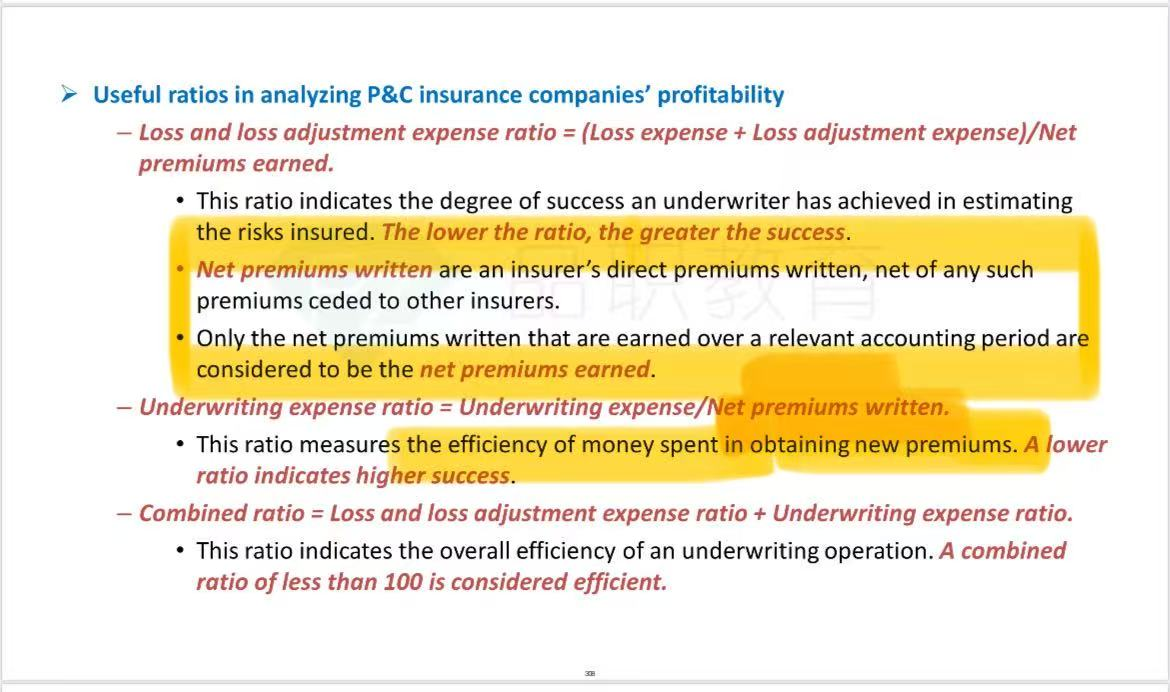

Which of the following statements best describes the efficiency of money spent in obtaining new premiums?

选项:

A.A.Insurer A is more efficient than Insurer B B.B.Insurer B is more efficient than Insurer A C.C.Both Insurer A and Insurer B are equally efficient解释:

Solution-

Incorrect because the underwriting expense ratios for Insurer A and Insurer B are equal, at 40%. Therefore, they are equally efficient.

-

Incorrect because the underwriting expense ratios for Insurer A and Insurer B are equal, at 40%. Therefore, they are equally efficient.

-

Correct because the underwriting expense ratios for Insurer A and Insurer B are equal, at 40%. Therefore, they are equally efficient. Underwriting expense ratio = Underwriting expense/Net premiums written. This ratio measures the efficiency of money spent in obtaining new premiums. A lower ratio indicates higher success. Since the ratios are equal, both Insurer A and Insurer B are equally efficient in terms of money spent in obtaining new premiums.

- describe key ratios and other factors to consider in analyzing an insurance company

本题计算为何采用保险年度而不是会计年度