NO.PZ202112010200002202

问题如下:

What is the approximate VaR for the bond position at a 99% confidence interval (equal to 2.33 standard deviations) for one month (with 21 trading days) if daily yield volatility is 1.50 bps and returns are normally distributed?

选项:

A.$1,234,105

$2,468,210

$5,413,133

解释:

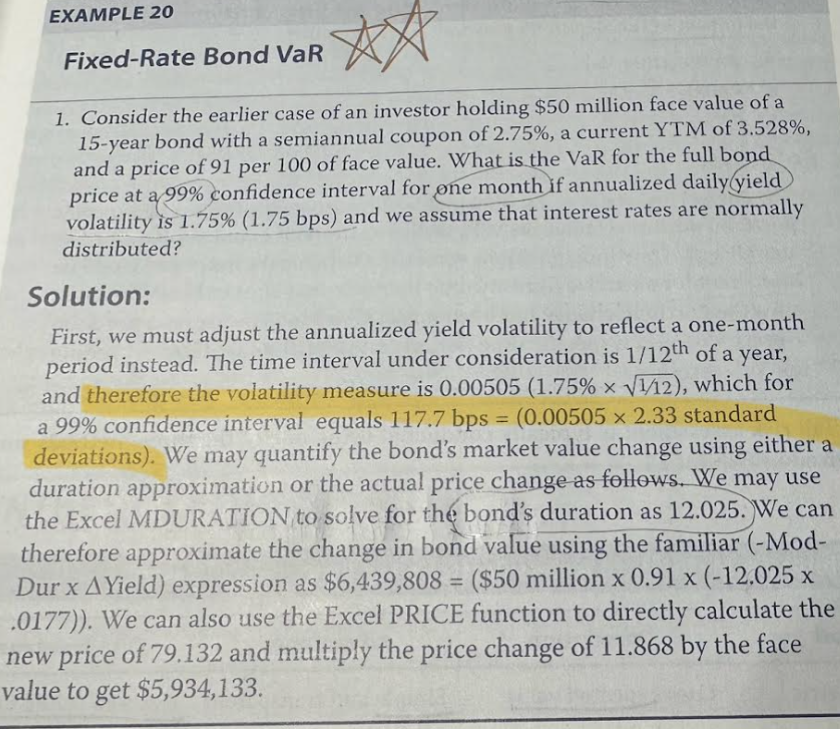

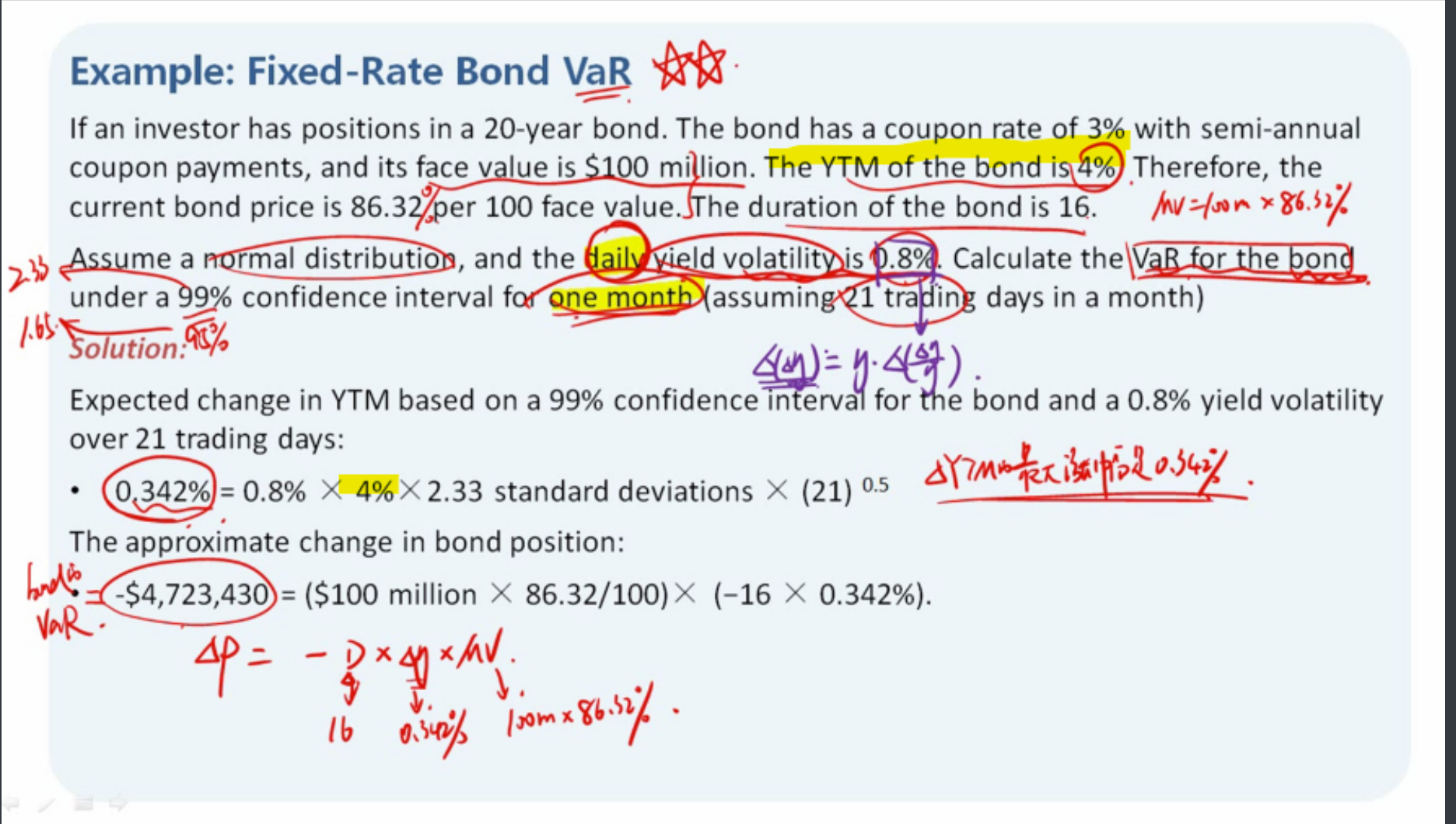

A is correct. The expected change in yield based on a 99% confidence interval for the bond and a 0.015% yield volatility over 21 trading days equals 16 bps = (0.015% × 2.33 standard deviations × √21).

We can quantify the bond’s market value change by multiplying the familiar (–ModDur × ∆Yield) expression by bond price to get $1,234,105 = ($75 million × 1.040175 ⨯ (–9.887 × .0016)).

书上是给的%的形式,乘以了YTM;课后题是两种形式都给了,但用的是bps(同时也疑惑,1.75%不等于1.75bps);课后题,即本题给的是bps,没有乘YTM。有点晕了,到底该怎么做呢?谢谢老师~