NO.PZ201809170400000107

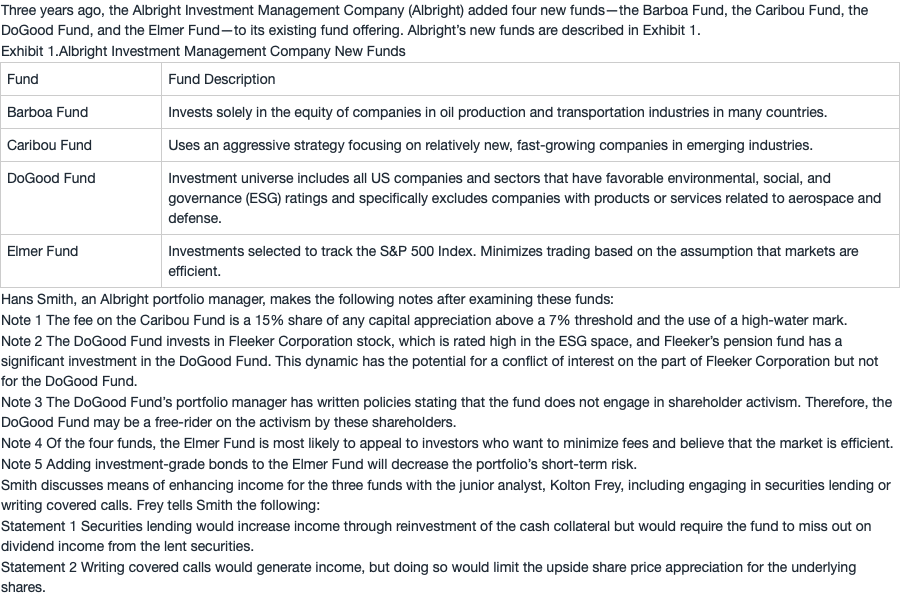

问题如下:

Which of the notes regarding the Elmer Fund is correct?

选项:

A.Only Note 4

B.Only Note 5

C.Both Note 4 and Note 5

解释:

A is correct. For passively managed portfolios, management fees are typically low because of lower direct costs of research and portfolio management relative to actively managed portfolios. Therefore, Note 4 is correct.

Note 5 is incorrect because the predictability of correlations is uncertain.

加入bond, 不是会增加diversiication吗, stock短期volatility大, 加入high-grade bond不正好降低了risk吗