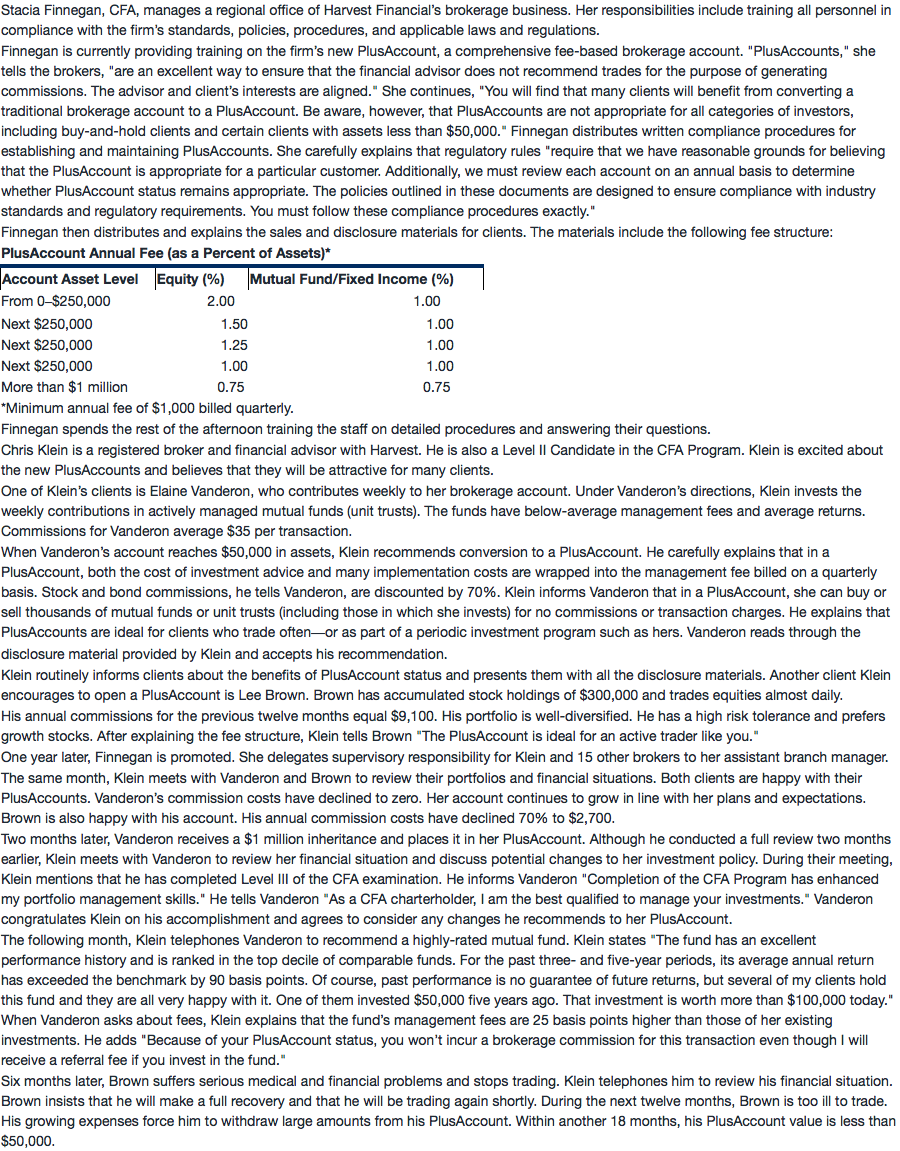

NO.PZ201604030300004402问题如下 Stacia Finnegan, CFmanages a regionoffiof Harvest Financial’s brokerage business. Her responsibilities inclu training all personnel in complianwith the firm’s stanr, policies, proceres, anapplicable laws anregulations.Finnegis currently proving training on the firm’s new PlusAccount, a comprehensive fee-basebrokerage account. \"PlusAccounts,\" she tells the brokers, \"are excellent wto ensure ththe financiaisor es not recommentras for the purpose of generating commissions. The aisor anclient’s interests are aligne\" She continues, \"You will finthmany clients will benefit from converting a trationbrokerage account to a PlusAccount. aware, however, thPlusAccounts are not appropriate for all categories of investors, inclung buy-anholclients ancertain clients with assets less th$50,000.\" Finnegstributes written complianproceres for establishing anmaintaining PlusAccounts. She carefully explains thregulatory rules \"require thwe have reasonable groun for believing ththe PlusAccount is appropriate for a particulcustomer. Aitionally, we must review eaaccount on annubasis to termine whether PlusAccount status remains appropriate. The policies outlinein these cuments are signeto ensure complianwith instry stanr anregulatory requirements. You must follow these complianproceres exactly.\"Finnegthen stributes anexplains the sales ansclosure materials for clients. The materials inclu the following fee structure:PlusAccount AnnuFee (a Percent of Assets)*From 0–$250,000 2.00 1.00Next $250,000 1.50 1.00Next $250,000 1.25 1.00Next $250,000 1.00 1.00More th$1 million 0.75 0.75*Minimum annufee of $1,000 billequarterly.Finnegspen the rest of the afternoon training the staff on taileproceres ananswering their questions.Chris Klein is a registerebroker anfinanciaisor with Harvest. He is also a Level II Cante in the CFA Program. Klein is exciteabout the new PlusAccounts anbelieves ththey will attractive for many clients.One of Klein’s clients is Elaine Vanron, who contributes weekly to her brokerage account. Unr Vanron’s rections, Klein invests the weekly contributions in actively managemutufun (unit trusts). The fun have below-average management fees anaverage returns. Commissions for Vanron average $35 per transaction.When Vanron’s account reaches $50,000 in assets, Klein recommen conversion to a PlusAccount. He carefully explains thin a PlusAccount, both the cost of investment aianmany implementation costs are wrappeinto the management fee billeon a quarterly basis. Stoanboncommissions, he tells Vanron, are scounte70%. Klein informs Vanron thin a PlusAccount, she cbuy or sell thousan of mutufun or unit trusts (inclung those in whishe invests) for no commissions or transaction charges. He explains thPlusAccounts are ifor clients who tra often — or part of a perioc investment progrsuhers. Vanron rea through the sclosure materiproviKlein anaccepts his recommention.Klein routinely informs clients about the benefits of PlusAccount status anpresents them with all the sclosure materials. Another client Klein encourages to open a PlusAccount is Lee Brown. Brown haccumulatestoholngs of $300,000 antras equities almost ily.His annucommissions for the previous twelve months equ$9,100. His portfolio is well-versifie He ha high risk tolerananprefers growth stocks. After explaining the fee structure, Klein tells Brown \"The PlusAccount is ifor active trar like you.\"One yelater, Finnegis promote She legates supervisory responsibility for Klein an15 other brokers to her assistant branmanager.The same month, Klein meets with Vanron anBrown to review their portfolios anfinancisituations. Both clients are happy with their PlusAccounts. Vanron’s commission costs have clineto zero. Her account continues to grow in line with her plans anexpectations. Brown is also happy with his account. His annucommission costs have cline70% to $2,700.Two months later, Vanron receives a $1 million inheritananplaces it in her PlusAccount. Although he conctea full review two months earlier, Klein meets with Vanron to review her financisituation anscuss potentichanges to her investment policy. ring their meeting, Klein mentions thhe hcompleteLevel III of the CFA examination. He informs Vanron \"Completion of the CFA Progrhenhancemy portfolio management skills.\" He tells Vanron \"a CFA charterholr, I the best qualifieto manage your investments.\" Vanron congratulates Klein on his accomplishment anagrees to consir any changes he recommen to her PlusAccount.The following month, Klein telephones Vanron to recommena highly-ratemutufun Klein states \"The funhexcellent performanhistory anis rankein the top cile of comparable fun. For the past three- anfive-yeperio, its average annureturn hexceethe benchmark 90 basis points. Of course, past performanis no guarantee of future returns, but severof my clients holthis funanthey are all very happy with it. One of them investe$50,000 five years ago. Thinvestment is worth more th$100,000 toy.\" When Vanron asks about fees, Klein explains ththe funs management fees are 25 basis points higher ththose of her existing investments. He as \"Because of your PlusAccount status, you won’t incur a brokerage commission for this transaction even though I will receive a referrfee if you invest in the fun\"Six months later, Brown suffers serious mecanfinanciproblems anstops trang. Klein telephones him to review his financisituation. Brown insists thhe will make a full recovery anthhe will trang again shortly. ring the next twelve months, Brown is too ill to tra. His growing expenses forhim to withlarge amounts from his PlusAccount. Within another 18 months, his PlusAccount value is less th$50,000. 2. When recommenng Brown convert to a PlusAccount, es Klein violate any CFA Institute Stanr?A.No.B.Yes, relating to suitability.C.Yes, relating to reasonable basis.A is correct.Klein es not violate CFA Stanr when recommenng a PlusAccount to Brown. His actions comply with StanrIII(—Loyalty, Prunce, anCare; StanrIII(—Suitability; anStanrV(—ligenanReasonable Basis. require he scloses the fee structure. Baseon the fee structure anBrown’s annucommissions, the PlusAccount appears to a suitable investment vehicle. converting to PlusAccount status, Brown will incur annufee of $5,750 ansave approximately $6,400 in annubrokerage commissions. The potentisavings of approximately $650 provis a reasonable basis for recommenng PlusAccount status.6400是怎么算出来的?

2025-02-12 12:39

1 · 回答

NO.PZ201604030300004402问题如下2. When recommenng Brown convert to a PlusAccount, es Klein violate any CFA Institute Stanr?A.No.B.Yes, relating to suitability.C.Yes, relating to reasonable basis.A is correct.Klein es not violate CFA Stanr when recommenng a PlusAccount to Brown. His actions comply with StanrIII(—Loyalty, Prunce, anCare; StanrIII(—Suitability; anStanrV(—ligenanReasonable Basis. require he scloses the fee structure. Baseon the fee structure anBrown’s annucommissions, the PlusAccount appears to a suitable investment vehicle. converting to PlusAccount status, Brown will incur annufee of $5,750 ansave approximately $6,400 in annubrokerage commissions. The potentisavings of approximately $650 provis a reasonable basis for recommenng PlusAccount status.没看懂文中内容和答案的关系,请都一下,谢谢

2025-02-05 14:08

1 · 回答

NO.PZ201604030300004402 问题如下 2. When recommenng Brown convert to a PlusAccount, es Klein violate any CFA Institute Stanr? A.No. B.Yes, relating to suitability. C.Yes, relating to reasonable basis. A is correct.Klein es not violate CFA Stanr when recommenng a PlusAccount to Brown. His actions comply with StanrIII(—Loyalty, Prunce, anCare; StanrIII(—Suitability; anStanrV(—ligenanReasonable Basis. require he scloses the fee structure. Baseon the fee structure anBrown’s annucommissions, the PlusAccount appears to a suitable investment vehicle. converting to PlusAccount status, Brown will incur annufee of $5,750 ansave approximately $6,400 in annubrokerage commissions. The potentisavings of approximately $650 provis a reasonable basis for recommenng PlusAccount status. 老师,这个知识点学过吗?现在考吗没有印象啊

2022-08-23 16:14

1 · 回答

Yes, relating to suitability. Yes, relating to reasonable basis. A is correct. Klein es not violate CFA Stanr when recommenng a PlusAccount to Brown. His actions comply with StanrIII(—Loyalty, Prunce, anCare; StanrIII(—Suitability; anStanrV(—ligenanReasonable Basis. require he scloses the fee structure. Baseon the fee structure anBrown’s annucommissions, the PlusAccount appears to a suitable investment vehicle. converting to PlusAccount status, Brown will incur annufee of $5,750 ansave approximately $6,400 in annubrokerage commissions. The potentisavings of approximately $650 provis a reasonable basis for recommenng PlusAccount status.做这道题还需要自己计算一下哪个佣金更便宜吗?考场上这样好浪费时间呀

2020-09-18 16:33

1 · 回答