NO.PZ2023081403000070

问题如下:

Q. Zimt AG wrote down the value of its inventory in 2017 and reversed the write-down in 2018. Compared to the results the company would have reported if the write-down had never occurred, Zimt’s reported that the 2018:选项:

A.profit was overstated. B.cash flow from operations was overstated. C.year-end inventory balance was overstated.解释:

A is correct. The reversal of the write-down shifted the cost of sales from 2018 to 2017. The 2017 cost of sales was higher because of the write-down, and the 2018 cost of sales was lower because of the reversal of the write-down. As a result, the reported 2018 profits were overstated. Inventory balance in 2018 is the same because the write-down and reversal cancel each other out. Cash flow from operations is not affected by the non-cash write-down, but the higher profits in 2018 likely resulted in higher taxes and thus lower cash flow from operations.

解答里说 “the higher profits in 2018 likely resulted in higher taxes and thus lower cash flow from operations” 。

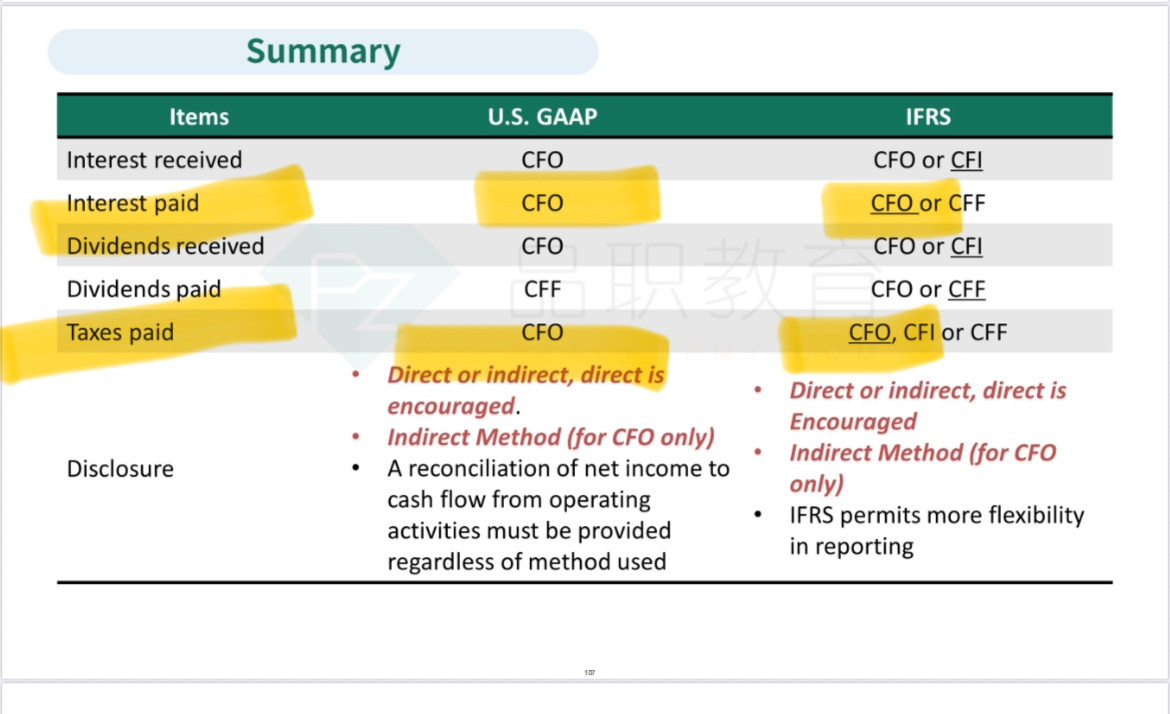

请问 higher taxes 为什么会导致 lower CFO 啊?我理解的是 CFO = EBIT,是一个 before-tax value