NO.PZ202207040100000803

问题如下:

The Epsilon Institute Case Scenario

The Epsilon Institute of Theoretical Physics is a non-profit corporation initially funded from government and private sources. Mitch Lazare is the chairman of the Investment Committee, which oversees the institute’s endowment fund, of which about $750 million is currently under active management. He is currently tasked with finding two additional investment managers to manage a portion of the actively managed funds and, along with his assistant, Brian Warrack, is reviewing the presentations made by several applicants.

John Fraser’s performance is the first that Lazare and Warrack review. Fraser’s fund is constructed with a discretionary approach using the four Fama–French factors; he uses the Russell 1000 Value Index as his benchmark. The most recent 10 years of performance data for both the fund and the benchmark are shown in Exhibit 1.

Exhibit 1

Fraser Fund and Benchmark Average Monthly Performance over the Past 10 years

As part of his evaluation of the applicants, Warrack compiles a record of the Active Share and active risk of the funds that they manage. He observes that the Mattley Fund has relatively high Active Share but relatively low active risk.

Lazare and Warrack make the following comments about Active Share and active risk in the context of a single-factor model:

The level of active risk will rise with an increase in idiosyncratic volatility.

The active risk attributed to Active Share will be smaller in more diversified portfolios.

If the factor exposure is fully neutralized, the Active Share will be entirely attributed to the active risk.

The manager of the Western Fund focuses on smaller companies in the Russell 1000 Value Index and uses the following constraints:

Size: The capitalization of the average company is $1.8 billion. On average, companies of this size trade 0.90% of their capitalization every day.

Liquidity: Positions can be no larger than 7% of average daily trading volume.

Allocation: Positions can be no larger than 1.75% of total assets under management.

Diversification: The portfolio must contain at least 60 securities.

If the manager of the Western Fund is hired by Epsilon, she will have $100 million of Epsilon’s funds to manage.

Lazare and Warrack turn their attention to the manager of the Herrick Fund, which is the only fund that involves substantial international exposure. Lazare believes that current political events in Country A may result in greater risk exposure than might be appropriate and wishes to investigate further.

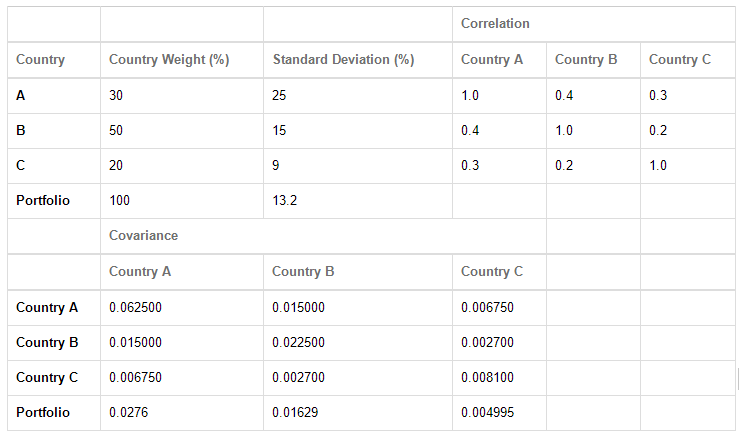

The Herrick Fund manager provides them with the information in Exhibit 2, which they use to carry out a risk attribution analysis.

Exhibit 2

The Herrick Fund—Risk Analysis

In Lazare and Warrack’s comments about Active Share and active risk, the comment that is least accurate is the one concerning:

选项:

A.portfolio diversification. B.neutralizing factor exposure. C.increasing idiosyncratic volatility.解释:

Solution

B is correct. The comment concerning neutralizing factor exposure is incorrect: In a single-factor model, if the factor exposure is neutralized, the active risk will be entirely attributable to the Active Share—a consequence of the manager deviating from benchmark weights. The active risk attributed to Active Share will be smaller for more diversified portfolios with lower idiosyncratic risk. Active risk does rise with an increase in factor and idiosyncratic volatility.

A is incorrect. The active risk attributed to Active Share will be smaller for more diversified portfolios with lower idiosyncratic risk.

C is incorrect. Active risk does rise with an increase in factor and idiosyncratic volatility.

中文解析:

本题考查的是大家对于Active Share and

Active Risk的理解。

需要特别注意的是选项的顺序和题干小点的顺序不一致。三个描述中的第三个小点(即选项B)的说法有误,正确的说法应该是If

the factor exposure is fully neutralized, the active risk will be entirely

attributed to the active Share. 它错在active Share和active Risk写反了。这句话描述的是因子的full neutralized,即组合在承担因子这个层面已经是充分分散化了(风险因子的attribution和benchmark几乎一样),但此时还有active

Risk说明组合的return依然和benchmark不一样,那就只有一种可能,就是基金经理买的股票 和benchmark不同但行业选的和benchmark是类似的即那这种情况下产生AR只可能源于active

share。打个比方,组合和benchmark都看好房地产,但组合投金地,而benchmark投万科。

The level of active risk will rise with an

increase in factor and idiosyncratic volatility。当组合的因子更加集中(非系统性风险上升),组合与benchmark更不像,active

risk也就跟着上升。这个描述是正确的。

The active risk attributed to Active Share

will be smaller in more diversified portfolios. 如果组合的分散化非常好,说明它包含股票数量很多,非系统性风险很小。此时组合和benchmark

应该很像,如果仍存在差别(只要有差别就有active

risk), 而组合已经包含了大量的股票,那么由于AS带来的active

risk就非常小了。这个描述也是正确的。

如果组合风险因子是高度分散化(Fully neutralized)的,Active Risk可能全都是由于Active Share引起的;

如果组合风险是高度分散化(Fully Diversified)的,Active Risk可能全都是由于相关系数引起的