NO.PZ202207040100000302

问题如下:

Grasmere Asset Management Case Scenario

Morgan Abernathy, Nathaniel Granville, and Gabriella Carlucci are analysts at Grasmere Asset Management (Grasmere), an investment firm that offers a diversified mix of actively managed equity and fixed-income investment funds. The firm follows the fundamental approach, using both bottom-up and top-down investment management strategies. The analysts meet regularly to discuss investment ideas and related topics.

The meeting begins with a discussion of the fundamental approach to active equity management strategies. The analysts make the following statements:

The approach is a subjective investment process that uses discretion in making decisions.

The portfolio manager’s selections are based on determining a security’s exposure to selected variables that predict its return.

The construction of a portfolio is generally done using a portfolio optimizer, which controls risk at the portfolio level.

The analysts then review Exhibit 1, which describes a selection of the Grasmere equity funds.

Exhibit 1

Grasmere Equity Funds

The analysts made the following points about the potential investments that Fund B might undertake. The fund should be interested in

investing in the shares of a potential acquirer, even in a consolidating industry;

taking a control position in a distressed company’s shares selling at a deep discount to its intrinsic value; and

using its expertise to make long-term investments involving companies in reorganization.

Grasmere’s larger funds have had an impressive long-term record compared with peers. In more recent times, however, the results have been lagging. Positions have become more concentrated than in the past, and the proportion of positions underperforming their respective industries has increased. Carlucci believes managers may have become subject to two biases: an illusion of control and confirmation bias. Carlucci asks Abernathy what steps he could recommend to address the effect of these biases.

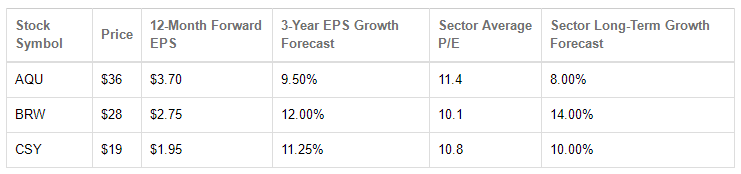

The final topic involves a discussion of some high-profile companies that recently released their full-year earnings results. Exhibit 2 contains market data and financial projections on three of the stocks discussed by Grasmere’s analysts. They are considering adding one of these stocks to Fund D.

Exhibit 2

Market Data and Financial Projections of Selected Stocks

Question

As described in Exhibit 1, Fund A most likely follows which investment strategy?

选项:

A.Contrarian B.Deep value C.Restructuring and distressed解释:

Solution

A is correct. Fund A most likely follows the contrarian investing approach. Contrarian managers invest in stocks with low or negative earnings or low dividends. Contrarians expect the stocks to rebound once the company’s earnings rebound. Contrarian investors often point to behavioral finance research that suggests that investors tend to overweight recent trends and follow the crowd in making investment decisions. Therefore, contrarian investors purchase and sell shares against prevailing market sentiment.

B is incorrect. Deep value investing focuses on undervalued companies, which are often in financial distress, that are available at extremely low valuations relative to their assets. The rationale is that market interest in such securities may be limited, which increases the chance of informational inefficiencies.

C is incorrect. Opportunities in restructuring and distressed investing are generally counter-cyclical relative to the overall economy or a sector’s business cycle. A distressed company that goes through restructuring may still have valuable assets, distribution channels, or patents that make it an attractive acquisition target. The goal of restructuring investing is to gain control or substantial influence over a company in distress at a large discount and then restructure it to restore a large part of its intrinsic value.

中文解析:

本题考查的是三种主动投资策略的辨析。

constrain

strategy反向操作或逆向操作,即和绝大多数人投资方向不一样,和人群唱反调(别人贪婪我恐惧,别人恐惧我贪婪)。逆向投资经理通常会选择投资于收益表现不佳、不受市场青睐的股票。逆向投资者预计,一旦该公司盈利出现反弹,其股价就会反弹更高。由此可见这是一种心里战术,而行为金融正是把心理学融入金融学的重要理论,通常题干会出现“behavioral finance”等关键词,说的正是Contrarian Investing。因此本题选A。

而Restructuring and Distressed Investing和deep in value,很像。

Restructuring

and Distressed Investing策略说的是,基金经理会对这些濒临破产的公司进行自下而上的分析,找到价值被低估的股票进行投资。这种策略经常用于在经济情况不好的时候,因为当经济低迷时,才会有大量公司面临破产重组,这些公司里面一定有仅仅因为大形势不好导致破产的公司,而只要宣告破产重组,公司的股票和债券价值均会迅速下跌。所以Restructuring and Distressed Investing就是投资那些基本面好但价值被严重低估的公司。

deep

value,这个策略也是投资于那些被严重低估的公司股票,特别是在金融危机的时刻。因此,它与Restructuring and Distressed Investing很类似,区别在于他们适用在不同程度的困境中。deep

value investing策略用在当公司当前有财务困境的时候(只是有困难,还没破产),而restructuring and distressed investing适用于马上要破产清算的情形当中。所以在这两种不同的阶段下,适用的策略不同,需要结合题目给出的关键词来判断。

题干说了“ companies with poor eamings performance”,上课讲了Value Investors和Contrarian Investors的对比,Contrarian Investors是基于Price Movement分析。更关注Price,在Value没变,而Price下跌/上涨的时候买入/卖出。这里明显Value变化了,仅仅因为“跟Investor Behavioral有关”这一理由就判断是Contrarian Investing十分不妥。