NO.PZ2025012208000024

问题如下:

Which of the following is most likely an active systematic approach to embedding ESG analysis in a portfolio?选项:

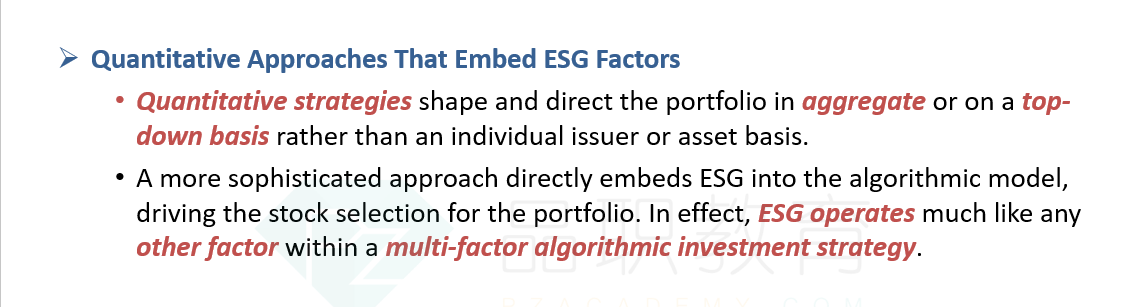

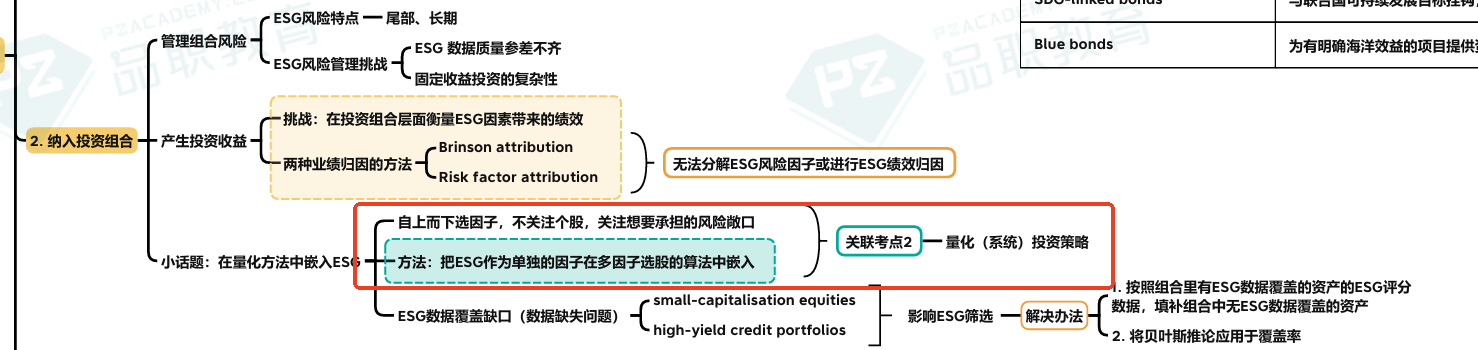

A.Weighting ESG as an idiosyncratic factor in a proprietary multi-factor stock selection algorithm B.Consideration of ESG scoring and relevant metrics in security-specific investment decisions C.Minimizing tracking error against ESG benchmark indexes解释:

A is correct. Using a multi-factor stock selection algorithm is a systematic ESG strategy because it directs the portfolio on a top-down basis, unlike a security-specific investment decision. Minimizing tracking error suggests an index-based, rather than active, approach.该题目体现在讲义的哪里?