NO.PZ202504150100006004

问题如下:

Question

In the share buyback discussion, the statement that is the least accurate is:

选项:

A.A.Statement 1.

B.B.Statement 2.

C.C.Statement 3.

解释:

Solution-

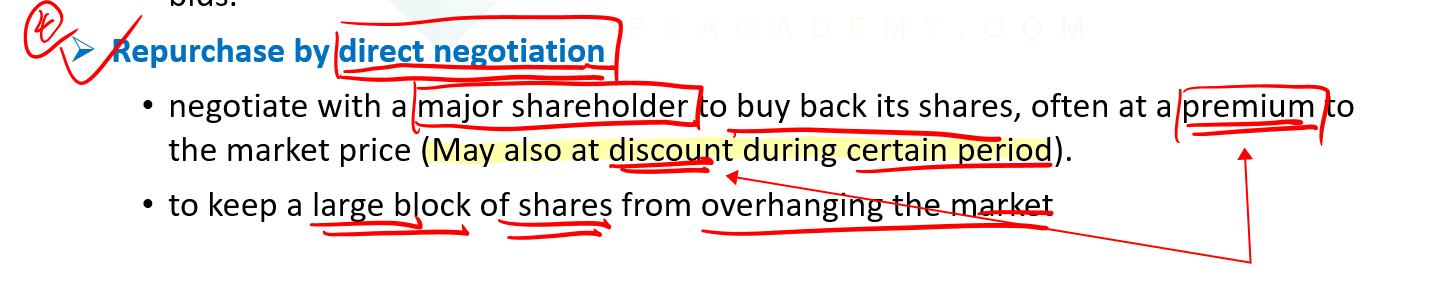

Correct because in a greenmail transaction, the company buys back the would-be suitor's shares at a premium to the market price, not at a discount. Unsuccessful takeover attempts have ended with the company buying back the would-be suitor’s shares at a premium to the market price, referred to as a greenmail transaction, often to the detriment of remaining shareholders.

-

Incorrect because it is an accurate statement. A fixed price tender offer can be extended to all shareholders and can set at a fixed date in the near future. A company will make a fixed price tender offer to repurchase a specific number of shares at a fixed price that is typically at a premium to the current market price. By setting a fixed date, such as 30 days in the future, a fixed price tender offer can be accomplished quickly.

-

Incorrect because it is an accurate statement. The open market share repurchase method gives the company maximum flexibility. Open market repurchases are the most flexible option for a company because there is no legal obligation to undertake or complete the repurchase program; a company may not follow through with an announced program for various reasons, such as unexpected cash needs for liquidity, acquisitions, or capital expenditures.

- compare share repurchase methods

没看懂statement 1,negotiate transaction 不应该是折价吗