NO.PZ202304050100000402

问题如下:

(2) If at acquisition, all of the equity securities that were eligible to be designated as fair value through profit or loss were so designated, the amount that the entire equity portfolio would contribute to Foster's net income for the year would have been closest to:

选项:

A.$11,000.

$26,000.

$21,000.

解释:

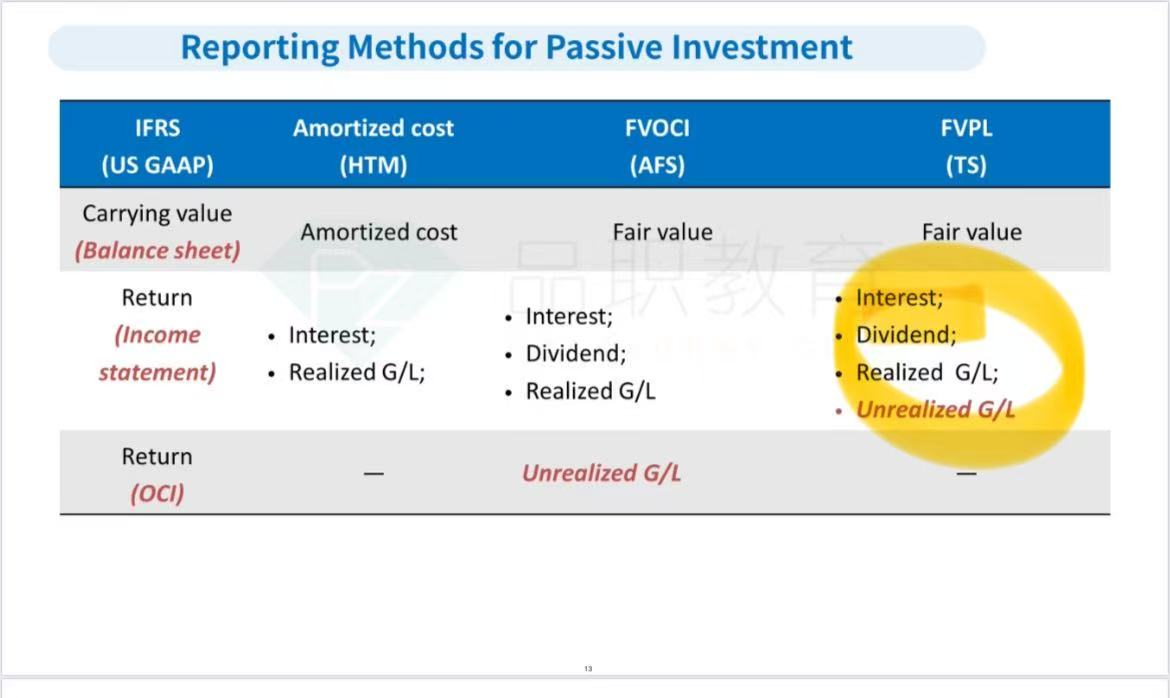

Only the equity securities that were designated as available for sale (Barker and Cosmic) could have been designated at fair value, and the unrecognized gains from those securities would then be included in income. Because Foster is a manufacturing company and not a venture capital or mutual fund company, it cannot account for its significant influence in Darnell using fair value.

Income would be equal to the dividends from Alton, Barker, and Cosmic plus the changes in market value for those same three securities plus the income from Darnell using the equity method.

没学过。。。。realized gain and loss不就是fair value的变化吗,since when和dividend有关系的