QUESTION SET 10

TOPIC: DERIVATIVES

TOTAL POINT VALUE OF THIS QUESTION SET IS 12 POINTS

Sarah Bransfield is the co-head of equities at Schwinn Asset Management (Schwinn). Schwinn’s offerings include many international mutual funds and ETFs focused on developed markets.

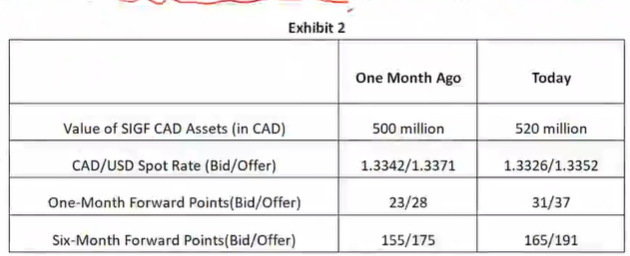

Schwinn’s existing clients have expressed interest in having part of their portfolios allocated to emerging market funds. To meet this growing interest from existing clients, Schwinn is formulating an investment strategy to create a new ETF. In this new ETF, Bransfield intends to hedge both international equity exposure and the currency exposure of emerging markets. To research and understand the emerging market space, Bransfield gathers details of the potential emerging markets as presented in Exhibit 1 and lists the following strategies. Note: all currency quotes are in terms of the number of currency units in the numerator per 1 unit of currency in the denominator.

Strategy 1: Implement a carry trade in the currency pair INR/USD.

Strategy 2: Implement a carry trade in the currency pair MXN/USD.

Strategy 3: Implement a carry trade in the currency pair TRY/USD.

The annual yield for the US is 5.25%.

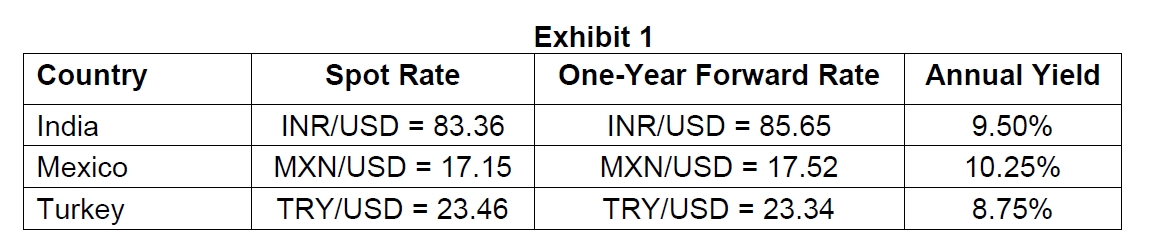

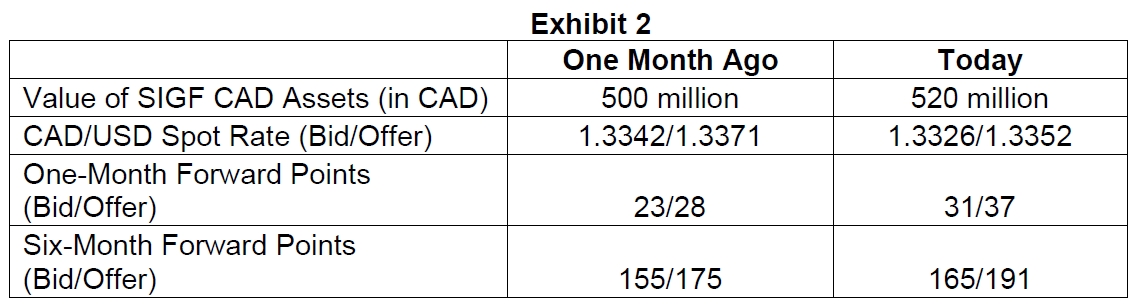

Bransfield seeks a deeper understanding of the derivatives used to hedge the exchange rate volatility of developed countries. She schedules a meeting with Jerry McGraw, the portfolio manager of Schwinn International Growth ETF (SIGF). In its prospectus to investors, SIGF indicates that it actively manages equity and foreign currency exposures and that the ETF uses dynamic hedging every month to rebalance existing hedges. One of the foreign currency asset holdings in SIGF is denominated in Canadian dollars (CAD). One month ago, SIGF fully hedged its exposure using a six-month CAD/USD forward contract per the details provided in Exhibit 2.

A. Calculate the total return for Strategy 1.

B. Calculate the amount SIGF needs to rebalance its CAD hedge today.