NO.PZ2018113001000038

问题如下:

A US company needs to raise CNY20 million because it is planning an expansion into China. It wants to issue dollar-denominated bonds and converts the dollars to Chinese yuan by using a three-year currency swap with annual payments. Spot rate is 7 CNY/USD, the swap rate of US dollars is 2% and the swap rate of Chinese yuan is 3%. The US company pays (in millions):

选项:

A.interest in CNY of 0.6 million and receives interest in USD of 0.045 million

B.interest in CNY of 0.6 million and receives interest in USD of 0.057 million

C.interest in USD of 0.057 million and receives interest in CNY of 0.6 million

解释:

B is correct.

考点:currency swap改变loan币种

解析:

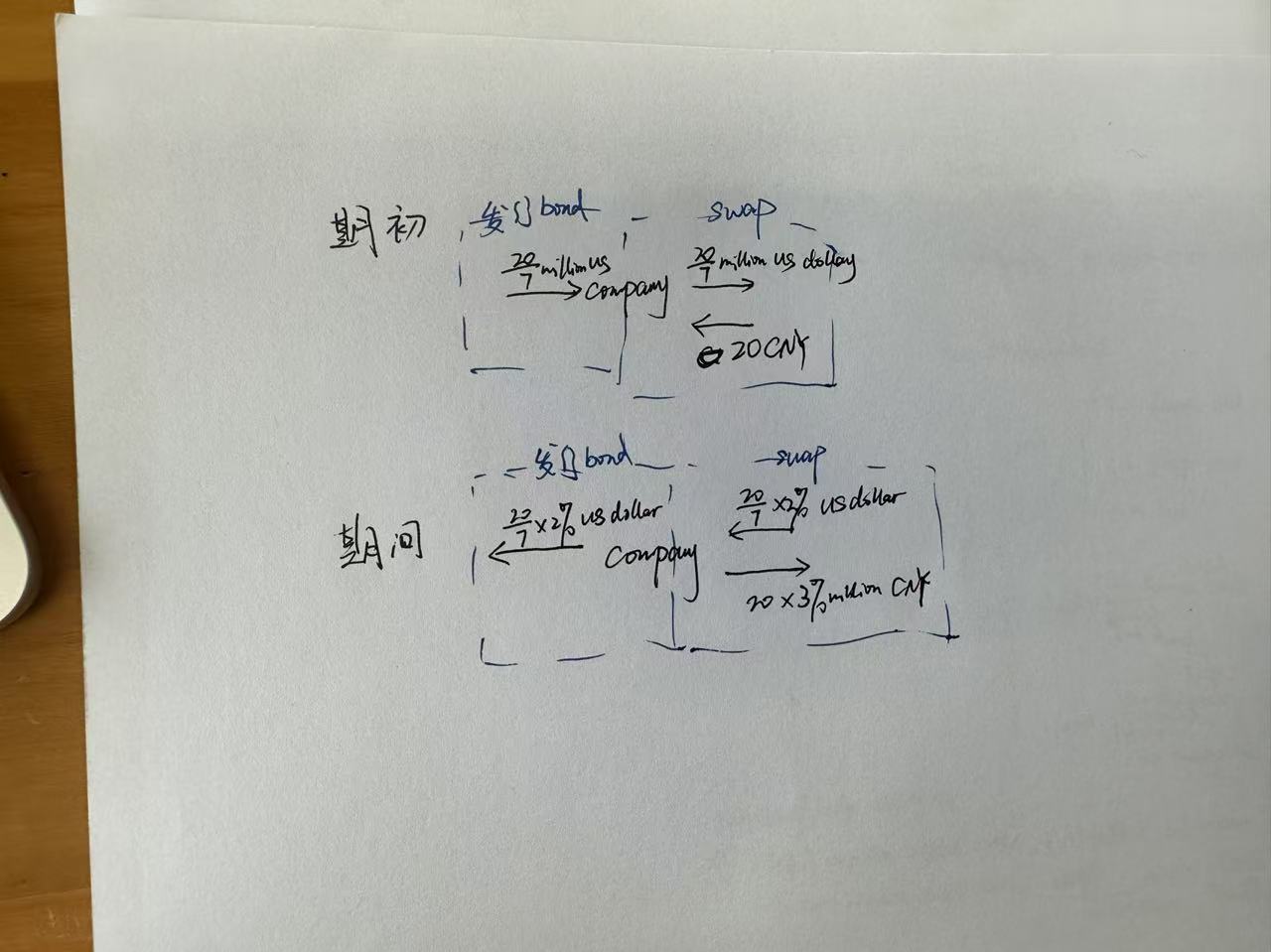

期初交换本金:收到人民币本金=20 million,支付美元本金=20/7=2.8571 million

期间交换利息:支付人民币利息=20*0.03=0.6million,收到美元利息=2.8571*0.02=0.057milion