NO.PZ2023100703000058

问题如下:

An analyst at a fixed-income investment company is evaluating different ways the company uses to estimate the VaR of its corporate bond portfolios. The portfolios consist of a large number of bonds with a wide range of maturities. The analyst examines the possibility of using a mapping approach to simplify the estimation process. Which of the following statements would the analyst be correct to make regarding the approaches to mapping fixed-income portfolios?选项:

A.The VaR estimated using the principal mapping approach understates the true risk of a portfolio since it ignores coupon payments and any risk associated with them. B.The VaR estimated using the duration mapping approach replaces the portfolio with a zero-coupon bond whose maturity equals the duration of the portfolio. C.The VaR estimated using the principal mapping approach differs from the undiversified VaR estimated using the duration mapping approach due to an adjustment made for correlations. D.The VaR estimated using the cash-flow mapping approach is less accurate than the VaR estimated using the duration mapping approach since it does not account for the timing of cash flows.解释:

B is correct. The process used in the duration mapping approach is to replace the portfolio of fixed-income investments with a single zero-coupon with a maturity equal to the duration of the portfolio. A is incorrect. Principal mapping overstates the true risk of the portfolio because it ignores coupon payments. Taking these payments into account decreases the duration of the portfolio, which decreases portfolio VaR. Therefore, principal mapping overstates the risk of the portfolio. C is incorrect. Undiversified VaR and the inclusion of correlations are associated with the cash-flow mapping approach rather than the duration mapping approach. There is a difference between the VaR estimated using the principal mapping approach and the diversified VaR estimated using the duration mapping approach due to the intervening cash flows. The principal mapping approach ignores intervening cash flows while they are implicitly accounted for in the duration mapping approach. D is incorrect. The VaR estimated using the cash-flow mapping approach is more accurate than the VaR estimated using the duration mapping approach since the cash-flow approach incorporates correlations into the estimation process.选项c的解释是:“Undiversified VaR and the inclusion of correlations are associated with the cash-flow mapping approach rather than the duration mapping approach. ”

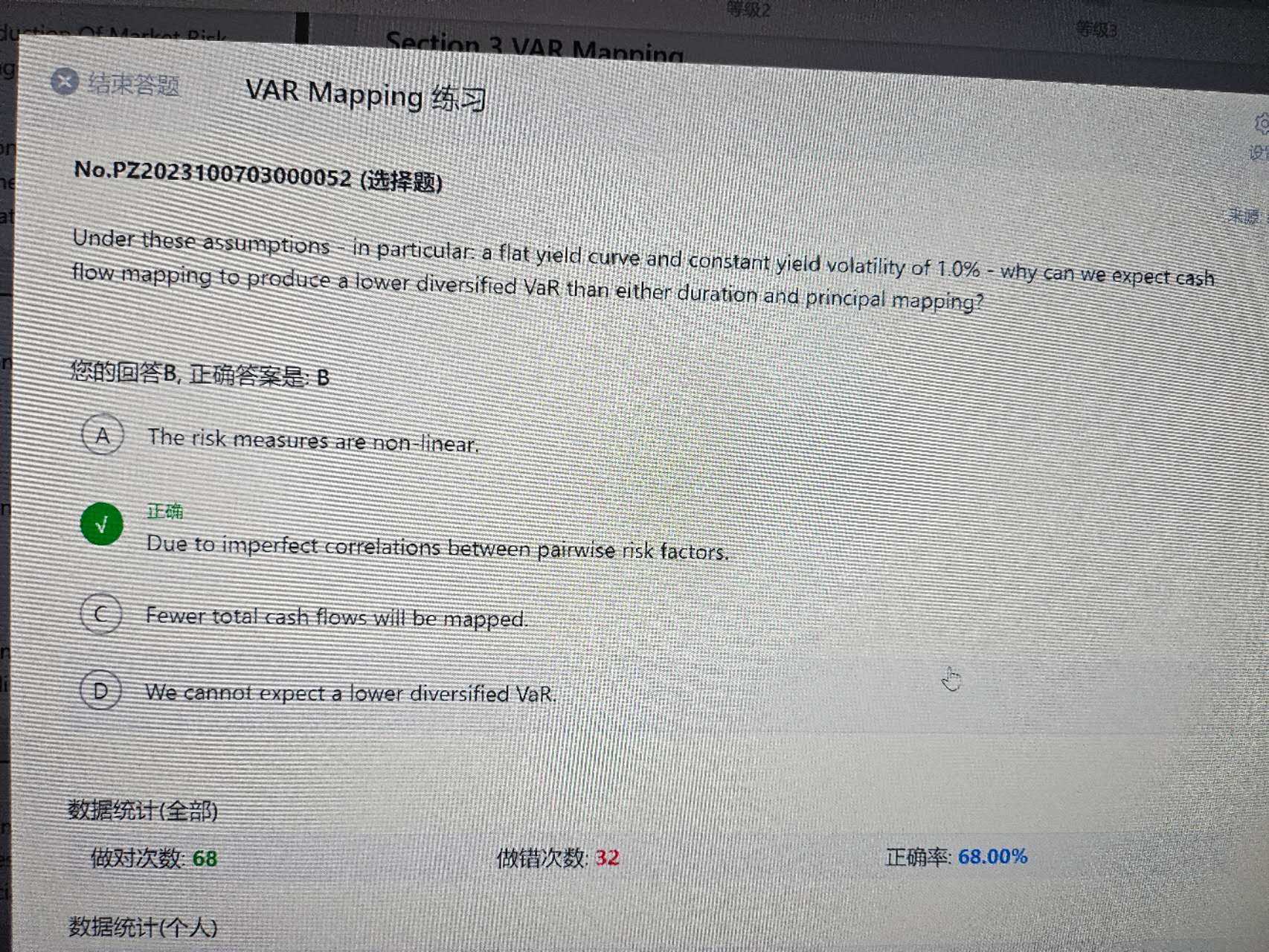

但是经典题2.2中题干说的是“why can we expect cash flow mapping to produce a lower diversified VaR”