NO.PZ2023100703000133

问题如下:

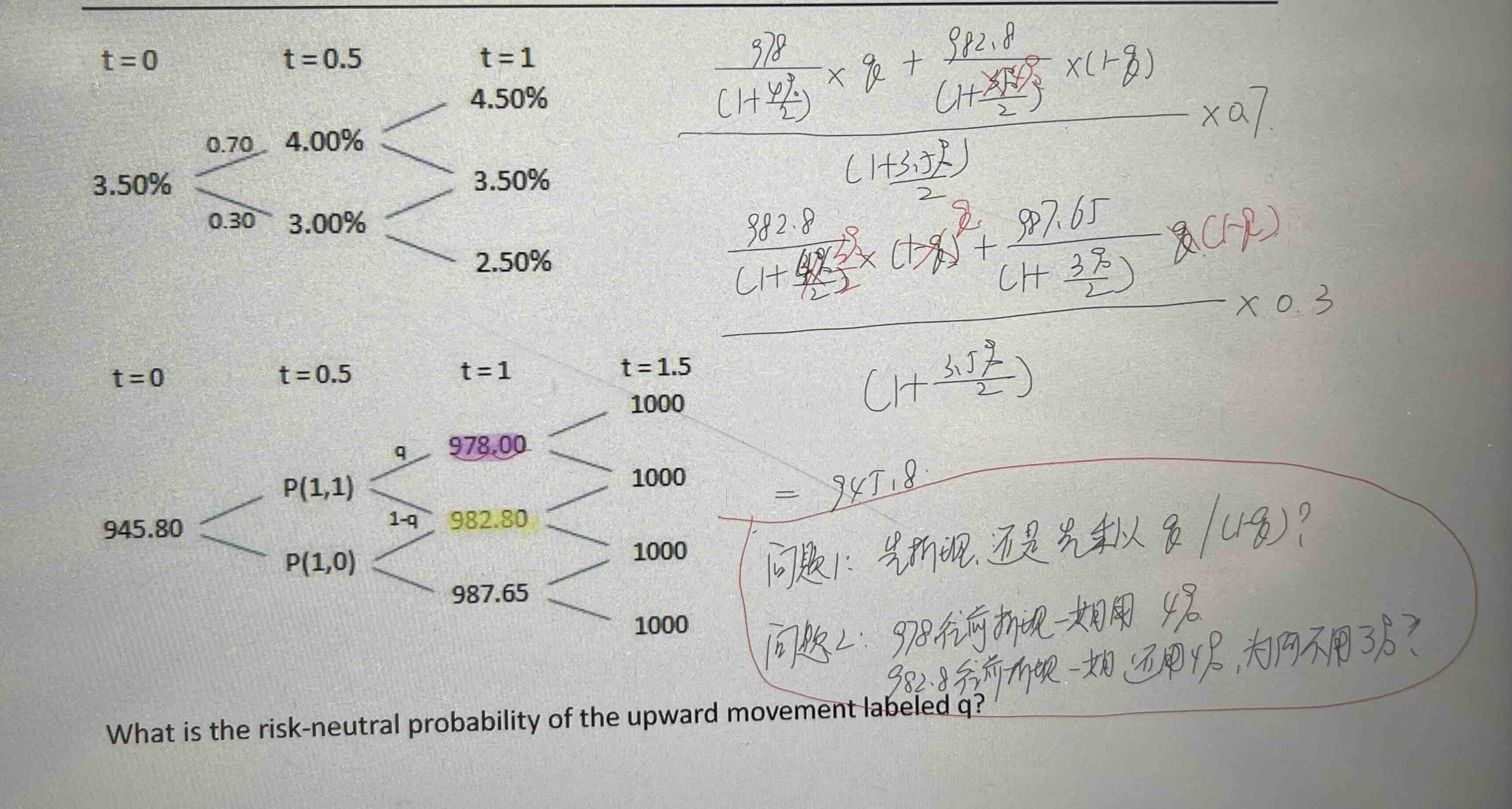

An analyst

on the fixed-income desk of an investment bank is calculating the risk neutral

probabilities of upward or downward movements in interest rates at various

nodes in a zero-coupon bond price tree. The analyst constructs an interest rate

tree of semi-annual spot interest rates quoted on an annualized basis, and a

price tree, both with semi-annual time steps, as shown below (t in years)

What is the

risk-neutral probability of the upward movement labeled q?

选项:

A.

0.15

B.

0.50

C.

0.70

D.

0.85

解释:

D is

correct. From the given rate tree and price tree, the equation for the price of

a 1.5-year zero-coupon bond at t = 0 is:

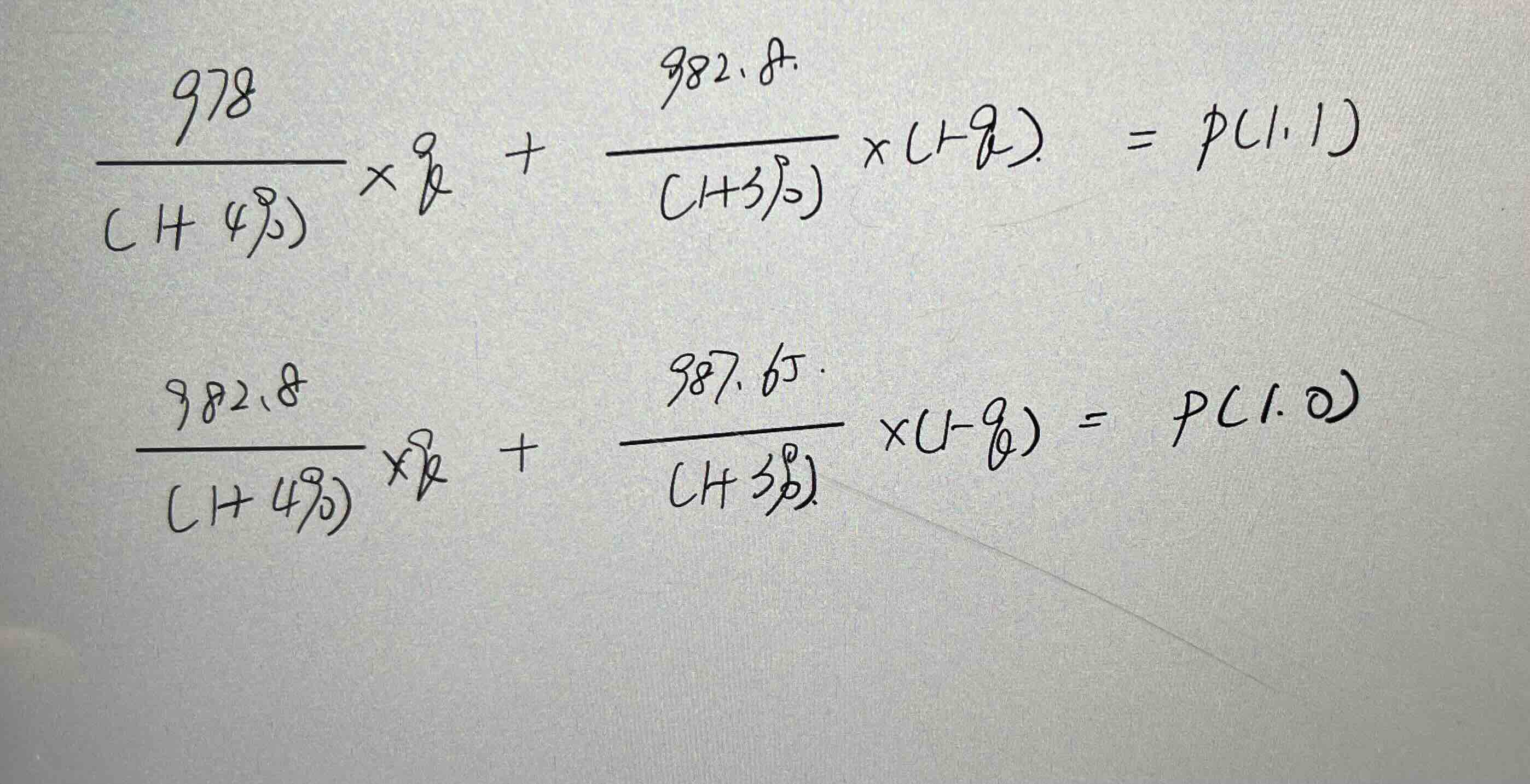

Equation 1:

(0.7 * P(1,1) + 0.3 * P(1,0)) / (1 + 0.035/2) = 945.80

and the

prices for the then 1-year bond at t = 0.5 are:

Equation 2:

P(1,1) = (978.00q + 982.80(1-q)) / (1 + 0.04/2)

Equation 3:

P(1,0) = (982.80q + 987.65(1-q)) / (1 + 0.03/2)

Substituting

Equations 2 and 3 into Equation 1 allows for q to be solved for algebraically,

resulting in q = 0.85.

A is

incorrect. This is the risk-neutral probability of a downward movement.

B is

incorrect. This incorrectly assumes that risk-neutrality indicates a

probability of ½.

C is incorrect. This assumes that the risk-neutral probability of an upward movement at t = 0.5 is equal to the risk-neutral probability of an upward movement at t = 0. As shown in the text, this is not the case.

老师,问题1,无论是求债券价格(不含权和含权)还是期权价格,到底是先折现再乘以概率,还是先乘以概率再折现?

问题2,982.8是价格下降,为什么还是用4%折现,不是3%?不应该是: