NO.PZ2025040202000004

问题如下:

Question An analyst gathers the following information about a put option on a non-dividend-paying stock:

The early exercise premium of the American-style put option at Time 0 is closest to:

选项:

A.A.0.54. B.B.0.59. C.C.0.67.解释:

A Correct because

the American-style put option value at Time 0 is calculated as p =

PV [πp+ + (1 – π)p–] =

(1/1.0205) × [(0.4498 × 0) + ((1 – 0.4498) × 15.88)] ≈ 8.5617.

The European-style put option at Time 0 is

calculated as p = PV [πp+ + (1 – π)p–]

= (1/1.0205) × [(0.4498 × 0) + ((1 – 0.4498) × 14.88)] ≈ 8.0225

Therefore the early exercise premium of the

American-style put option at Time 0 is 8.5617 – 8.0225 ≈ 0.54.

PV = present value factor = 1 / (1 + r) = 1

/ 1.0205

π =

probability of up move = [ FV(1) – d ] / (u – d)

= (1.0205 – 0.6562) / (1.4662 – 0.6562) ≈ 0.4498

For the American-style calculation:

p+ = put exercise value at Time 1 with up move = Max [0, Strike –

Underlying stock price at Time 1 with up move] = Max [0, 50.00 – 76.24] = 0

p– = put exercise value at Time 1 with down move = Max [0, Strike

– Underlying stock price at Time 1 with down move] = Max [0, 50.00 – 34.12] =

15.88

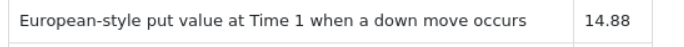

For the European-style calculation:

p+ = put value at Time 1 with up move (given) = 0

p– = put value at Time 1 with down move (given) = 14.88

where:

u = up

factor (total return) = S+ / S =

76.24 / 52.00 ≈ 1.4662

d =

down factor (total return) = S- / S =

34.12 / 52.00 ≈ 0.6562

where:

FV(1) = future value at Time 1 = 1 / PV(1)

= 1 + r = 1.0205

S+ = value of underlying at Time 1 when an up move occurs = 76.24

S- = value of underlying at Time 1 when a down move occurs =

34.12

S = value of underlying at Time 0 = 52.00

老师 ,这个到期时欧式期权的payoff 为什么是14.88?