NO.PZ2025040202000002

问题如下:

A trader engages in a strategy that replicates the payoff of a long position in a put option within a single-period binomial framework. At time step 0, the cash flow is:选项:

A.A.negative. B.B.zero. C.C.positive.解释:

A Incorrect because the trading strategy

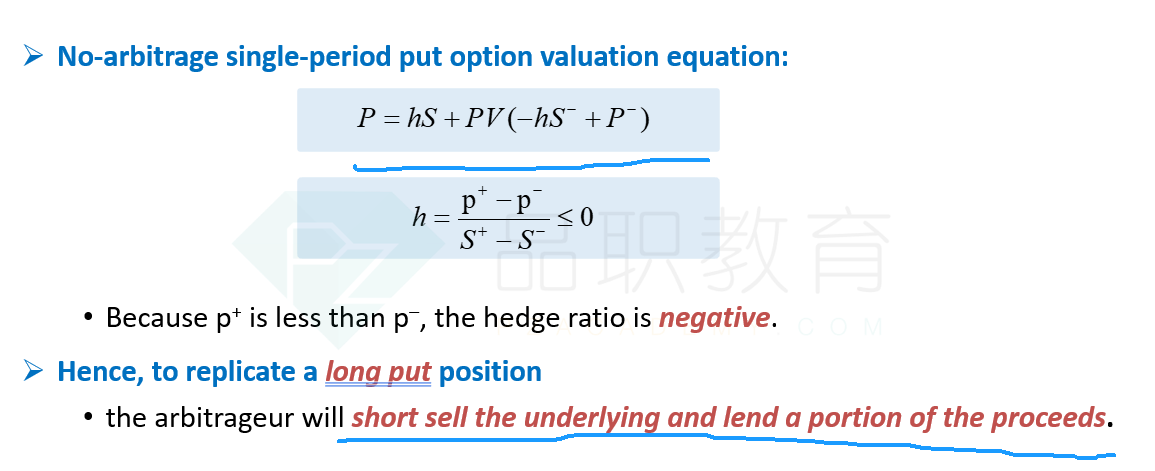

that will generate the payoff of taking a long position in a put option is to

short sell -h=-(p+-p-)/(S+-S-)

units of the underlying and financing of -PV(-hS-+p-).

Because p+ is less than p-, the hedge ratio is

negative. With h negative, the trade is a short sale, and because -h is

positive, the value -hS results in a positive cash flow at Time Step 0.

Therefore, the cash flow is not negative.

B Incorrect because the trading strategy

that will generate the payoff of taking a long position in a put option is to

short sell the underlying and financing, therefore, the cash flow is not zero.

C Correct because

the trading strategy that will generate the payoff of taking a long position in

a put option is to short sell -h=-(p+-p-)/(S+-S-)

units of the underlying and financing of -PV(-hS-+p-).

Because p+ is less than p-, the hedge ratio is

negative. With h negative, the trade is a short sale, and because -h is

positive, the value -hS results in a positive cash flow at Time Step 0.

老师麻烦解释一下这道题,没有明白题目考查的是什么?