NO.PZ2022061307000061

问题如下:

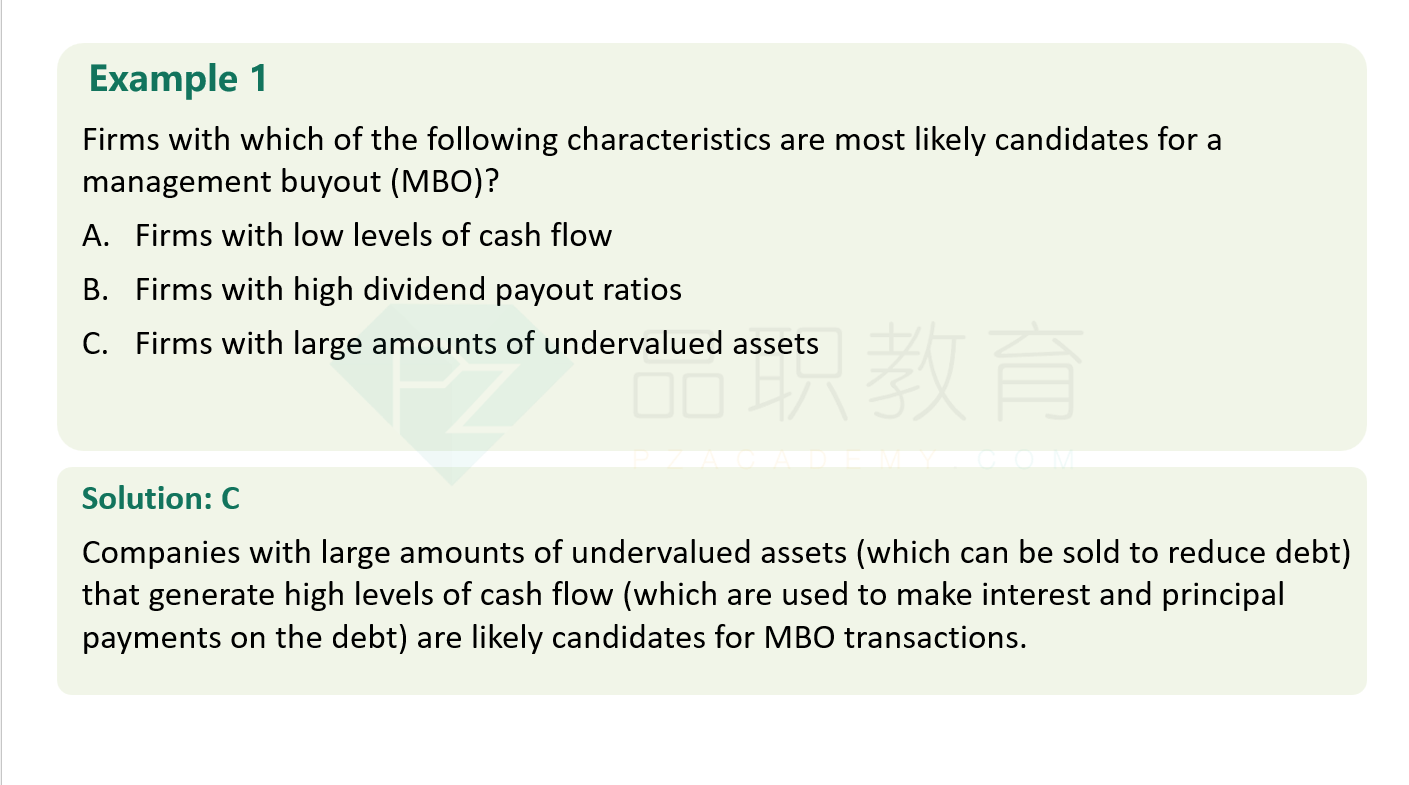

Question Firms with which of the following characteristics are most likely candidates for a management buyout (MBO)?

选项:

A.Firms with low levels of cash flow

B.Firms with high dividend payout ratios

C.Firms with large amounts of undervalued assets

解释:

SolutionC is correct. Companies with large amounts of undervalued assets (which can be sold to reduce debt) that generate high levels of cash flow (which are used to make interest and principal payments on the debt) are likely candidates for MBO transactions.

B is incorrect. A high dividend payout ratio is not a preferred characteristic for MBO.

A is incorrect. Companies with low levels of cash flow are not preferred candidates for MBO.

能解释一下吗,然后MBO是什么意思来着