NO.PZ2024011002000130

问题如下:

Assume U.S. GAAP applies unless otherwise noted. Deltax Corp., a highly profitable company, purchased a new asset on 1 January 2002 for $1,000,000. The following information applies to the asset:

- For financial statements purposes, straight-line depreciation over 10 years with no salvage value

- For tax purposes, three-year MACRS depreciation class with first year MACRS factor = 0.333

- Tax rate = 40%

选项:

A.$233,000 decrease. B.$93,200 decrease. C.$93,200 increase.解释:

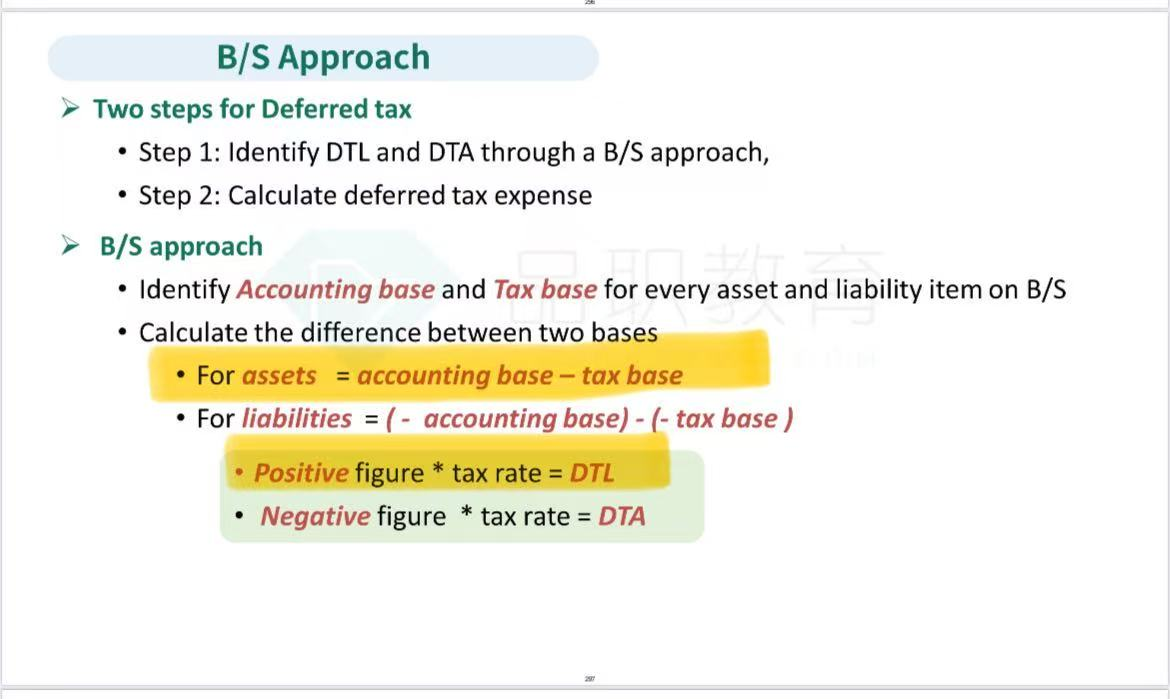

The timing difference results in an increase in deferred tax liability: ($333,000-$100,000)0.40= $93,200如果会计上按照折旧法,剩余价值是900000,如果税法上按照计提折旧,剩余价值是667000,那么不是会计上的需要交的税更多吗(是否是剩余价值越高,这部分要交的税越高呢?),现在多交税了,那以后不是可以抵减更多税吗?那不是DTA增大吗?DTL怎么变化呢?