NO.PZ2023040402000038

问题如下:

In a discussion with Blass about ESG factors in investment analysis, Yorkton makes the following statements:

- Statement 1 Material ESG information used in investment analysis is best obtained from the individual companies.

- Statement 2 The level of disclosure varies among companies because these disclosures are voluntary.

- Statement 3 The time horizon has little effect on the materiality of the underlying ESGfactors.

选项:

A.Statement 1

Statement 2

Statement 3

解释:

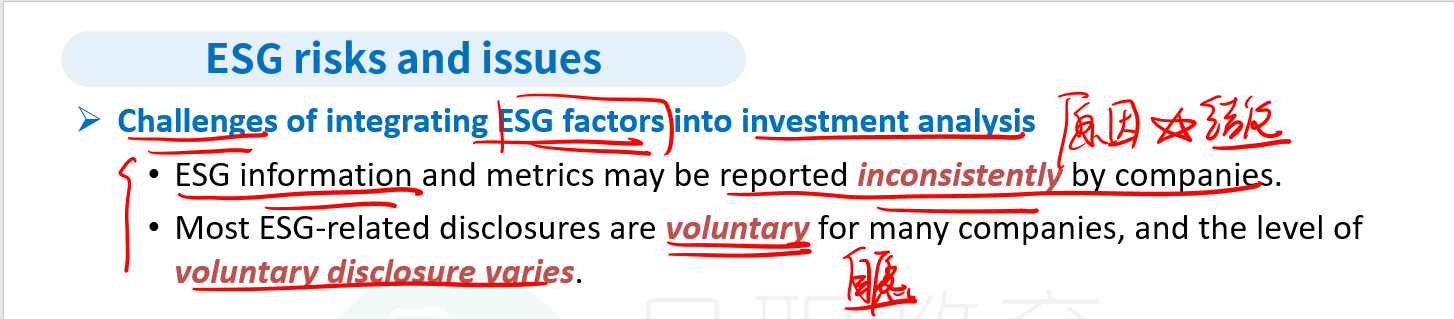

B is correct. Statement 2 is correct because the level of disclosure varies considerably among companies since ESG-related disclosures are voluntary. This creates a comparability issue for analysts. This is a problem associated with the proprietary methods used to identify company and industry ESG factors.

A is incorrect because Statement 1 is incorrect. The problems in doing ESG investment analysis based on company information are that the reporting of this information is inconsistent and that disclosures vary among companies.

C is incorrect because Statement 3 is incorrect. The time horizon is an important factor affecting the materiality of the underlying ESG factors. Some ESG issues may affect a company’s performance in the short term, whereas other issues may be more relevant in the long term. This is especially true in credit analysis because of the different maturities of the bonds.

请老师讲解