NO.PZ2022010501000004

问题如下:

Use the information in the following table to answer this question (amounts in €):

Calculate the rate of return for this portfolio for January, February, March, and the first quarter of 2019 using revaluing for large cash flows methodology (assume “large” is defined as greater than 5%).

选项:

解释:

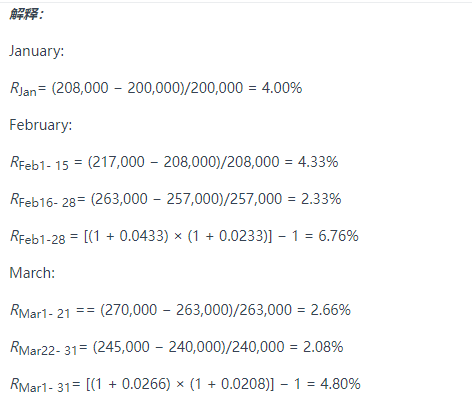

January:

RJan= (208,000 − 200,000)/200,000 = 4.00%

February:

RFeb1- 15 = (217,000 − 208,000)/208,000 = 4.33%

RFeb16- 28= (263,000 − 257,000)/257,000 = 2.33%

RFeb1-28 = [(1 + 0.0433) × (1 + 0.0233)] − 1 = 6.76%

March:

RMar1- 21 == (270,000 − 263,000)/263,000 = 2.66%

RMar22- 31= (245,000 − 240,000)/240,000 = 2.08%

RMar1- 31= [(1 + 0.0266) × (1 + 0.0208)] − 1 = 4.80%

Quarter 1:

RQT1 = [(1 + 0.0400) × (1 + 0.0676) × (1 + 0.0480)] − 1 = 16.36%

答案直接用1月2月3月的值相乘减一算的一季度return,为什么不是按CF来划分阶段来算呢?