NO.PZ2024011002000052

问题如下:

The following partial common-size cash flow statement and coverage ratio information is available for a company:

Compared with 2015, the most appropriate

conclusion an analyst can make about 2016 is that the company’s ability to use

operating cash flows to:

选项:

A.pay dividends decreased. B.acquire assets, pay debts, and make distributions to owners decreased. C.acquire assets improved.解释:

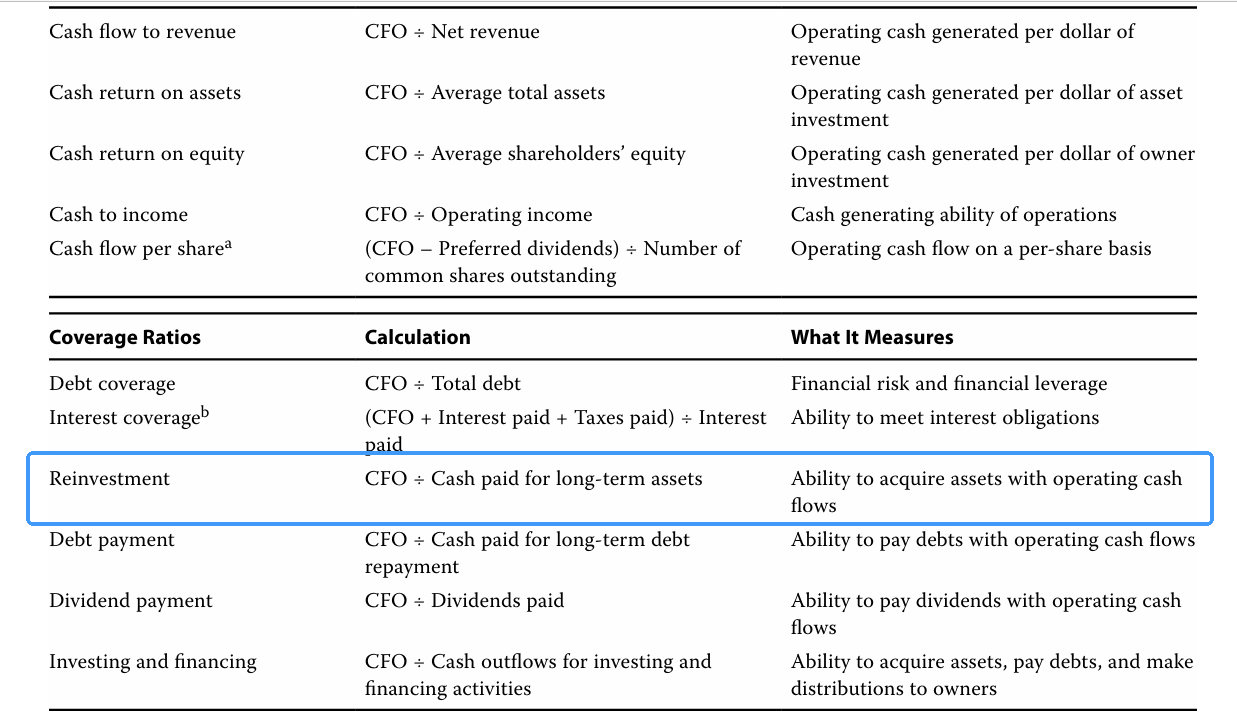

The company’s dividend payment coverage ratio worsened; therefore, the company was less able to pay dividends from operating cash flows. Calculations are as follows:

答案说 Reinvestment (ability to acquire assets):CFO/Cash paid for long term assets = 28.5/13.4= 2.13,reinvestment不是再投资的意思吗,收到的Return进行再投资,而acquire assets是指买设备等的投资,不一样吧,而且分母是13.4,为什么不把other investing这项也加上?