NO.PZ2024101001000039

问题如下:

Question When conducting a discounted cash flow valuation of a company that has a defined benefit pension plan, it is most appropriate to:

选项:

A.A.add the funded status of an underfunded plan to debt.

B.B.subtract the funded status of an overfunded plan from debt.

C.C.subtract future service and interest costs from free cash flow.

解释:

Solution-

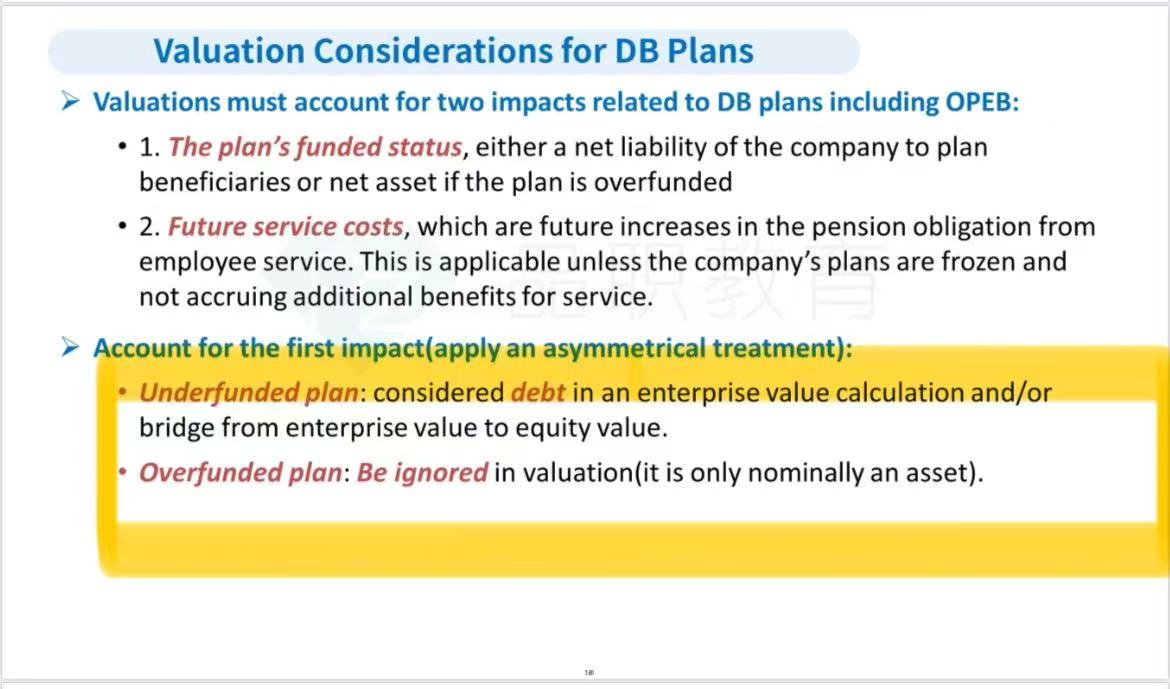

Correct because to account for the first impact, analysts apply an asymmetrical treatment of underfunded and overfunded plans. The funded status for an underfunded plan is considered debt in an enterprise value calculation and/or bridge from enterprise value to equity value. An overfunded plan is ignored in valuation.

-

Incorrect because an overfunded plan should be ignored in valuation.

-

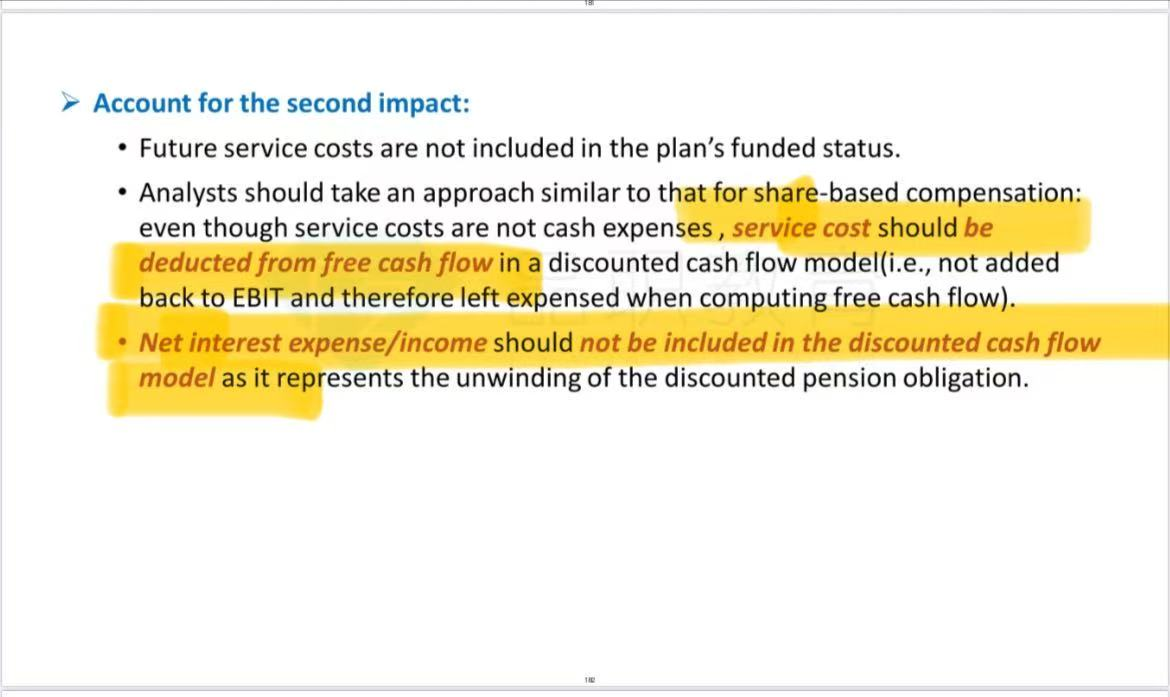

Incorrect because interest costs should not be deducted. Even though service costs are not cash expenses, service cost should be deducted from free cash flow in a discounted cash flow model. Net interest expense/income should not be included in the discounted cash flow model as it represents the unwinding of the discounted pension obligation.

- explain financial modeling and valuation considerations for post-employment benefits

可以解释一下选项是为什么么