NO.PZ2024061801000052

问题如下:

Consider a one-year European put option that is currently valued at $5 on a $25 stock and a strike of $27.50. The one-year risk-free rate is 6%. Which of the following amounts is closest to the value of the corresponding call option?

选项:

A.$0.00.

B.$3.89.

C.$4.06.

D.$5.00.

解释:

c = p − PV(X) + S0 = $5 − ($27.50 / 1.06) + $25 = $4.06

Consider a one-year European put option that is currently valued at $5 on a $25 stock and a strike of $27.50. The one-year risk-free rate is 6%. Which of the following amounts is closest to the value of the corresponding call option?

您的回答C, 正确答案是: C

A

$0.00.

B

$3.89.

C

正确$4.06.

D

$5.00.

数据统计(全部)

做对次数: 35

做错次数: 5

正确率: 87.50%

数据统计(个人)

做对次数: 1

做错次数: 0

正确率: 100.00%

解析

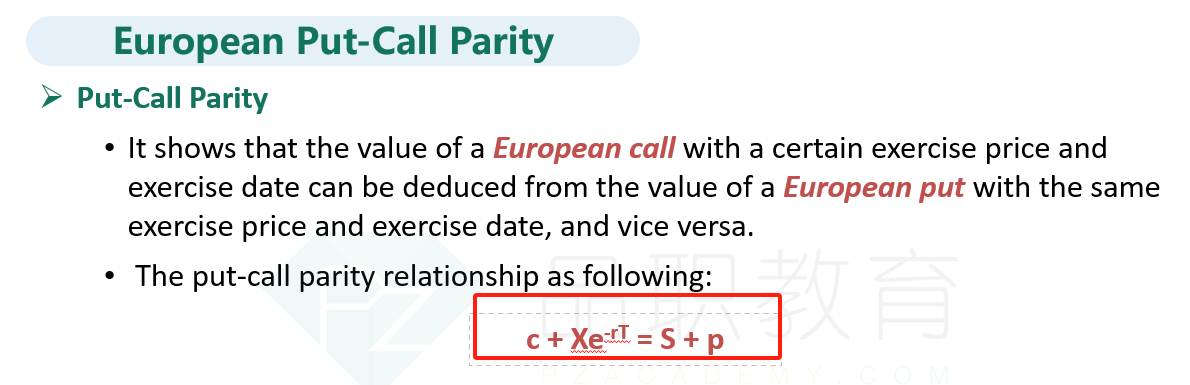

c = p − PV(X) + S0 = $5 − ($27.50 / 1.06) + $25 = $4.06

Why the answer here is not using Continuous Compounding, e^(-rT) to calculate? Thank you