NO.PZ2025040202000019

问题如下:

Question An analyst gathers the following Black–Scholes–Merton option valuation model outputs for a call option on a non-dividend-paying stock:

The probability that the call option expires in the money is:

选项:

A.A.40.6%. B.B.48.8%. C.C.59.4%.解释:

A Incorrect because N(−d2), or 40.6%, is the probability that the put option

expires in the money, not the call option.

B Incorrect because N(d2) is the

probability that the call option expires in the money, not d1. N(x)

denotes the standard normal cumulative distribution function, which is the

probability of obtaining a value of less than x based on a standard normal

distribution. Also, x will have the value of d1 or d2.

N(x) reflects the likelihood of observing values less than x from a random

sample of observations taken from the standard normal distribution.

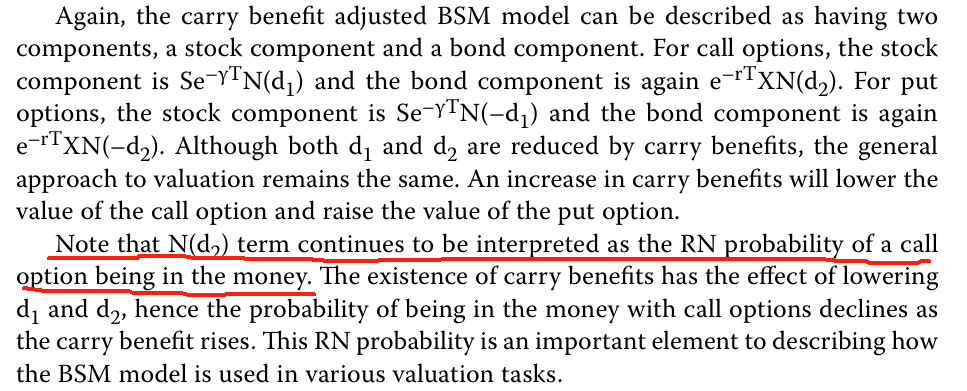

C Correct because

the N(d2) term (being 59.4%) has an additional important

interpretation. It is a unique measure of the probability that the call option

expires in the money, and correspondingly, 1 – N(d2) = N(−d2) is the probability that the put option expires in the

money. Specifically, the probability based on the RN probability of being in

the money, not one’s own estimate of the probability of being in the money nor

the market’s estimate. That is, N(d2) = Prob(ST >

X) based on the unique RN probability.

这道题是什么意思?这个知识点老师好像没有讲过