NO.PZ2023102101000009

问题如下:

As a risk manager for Bank ABC is asked to calculate the market riskcapital charge of the bank’s trading portfolio under the internal modelsapproach using the information given in the table below. Assuming the return ofthe banks trading portfolio is normally distributed, what is the market riskcapital charge of the trading portfolio?

VaR (95%, 1-day) of last trading day USD 30,000

Average VaR (95%, 1-day) for last 60 tradingdays USD 20,000

Multiplication Factor 3

选项:

A.

USD 84,582

B.

USD 134,594

C.

USD 189,737

D.

USD 267,471

解释:

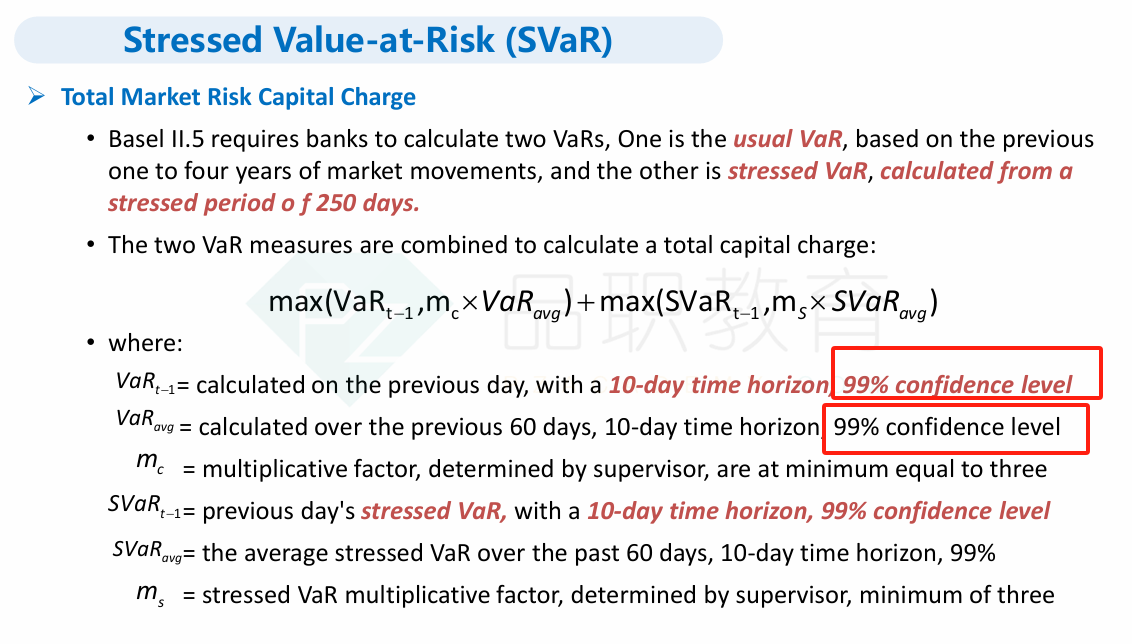

Market Risk Capital Charge

MAX (30,000 × SQRT(10)/1.65 × 2.326, 3 ×20,000 × SQRT (10)/1.65 × 2.326) = 267,471

Candidate is required to convert the VaR (95%, 1-day)to a 95% 10-day VaR.

为什么要除以1.65 ,再乘以2.32