NO.PZ202502120200000202

问题如下:

Which of the following properties is least likely to be in the oversupply phase of its real estate cycle, based on Tang’s argument?

选项:

A.A.The office building in New York City

B.B.The retail center in Miami

C.C.The multi-family complex in Boston

解释:

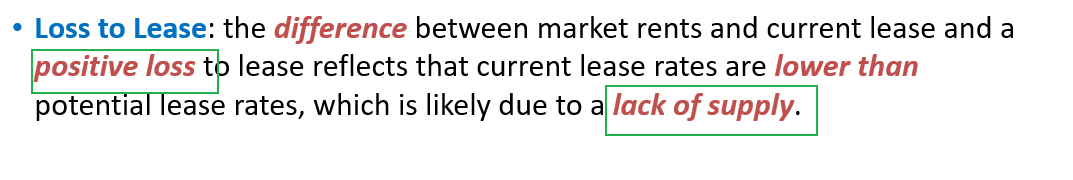

C is correct. The difference between gross potential rental income and gross rental income is represented by the loss to lease figure. A positive loss to lease reflects that current lease rates are lower than potential lease rates. The multi-family complex in Boston is the only property of the three for which gross rental income is lower than potential income. This is likely due to a lack of supply of rental housing. Responses A and B are both incorrect because the negative loss to lease may indicate excess supply and a likelihood that lease rates are decreasing.

波士顿的房产租赁损失为正数,我理解是因为租不满导致的,所以波士顿的房产应该是供给太多,供过于求。

我哪里理解错了吗?