NO.PZ2023091601000019

问题如下:

A quantitative analyst is constructing a stock selection algorithm that

will be employed in making intraday trades and uses the annual returns of two

utility stocks, stock A and stock B, to test the model’s capacity to capture

dependence between stock returns. The 5 years of annual returns data for each

stock used in the test are shown in the following table:

The analyst

estimates that the sample means of the returns of stock A (μA) and

stock B (μB) are 0.146 and 0.138, respectively. What is the unbiased

estimate of the sample covariance of stocks A and B?

选项:

A.

0.003828

B.

0.003892

C.

0.004785

D.

0.004865

解释:

D is correct.

Using the formula for the sample covariance estimator but dividing by n-1 for

an unbiased estimate, we get

𝜎𝐴𝐵=1/(𝑛−1)Σ(𝑅𝐴,𝑖−𝜇𝐴)∗(𝑅𝐵,𝑖−𝜇𝐵)

Which is expanded

as

1/4[(0.18−0.146)(0.32−0.138)+(0.13−0.146)(0.22−0.138)+(0.04−0.146)(0.00−0.138)+(0.30−0.146)(0.10−0.138)+(0.08−0.146)(0.05−0.138)]=(14)∗(0.01946)=0.004865

A is incorrect.

This is the result when the two means are switched in the summation formula and

the multiplier used is 1/5.

B is incorrect.

This is the result when the multiplier used is 1/5 instead of 1/(5-1).

C

is incorrect. This is the result when the two means are switched in the

summation formula.

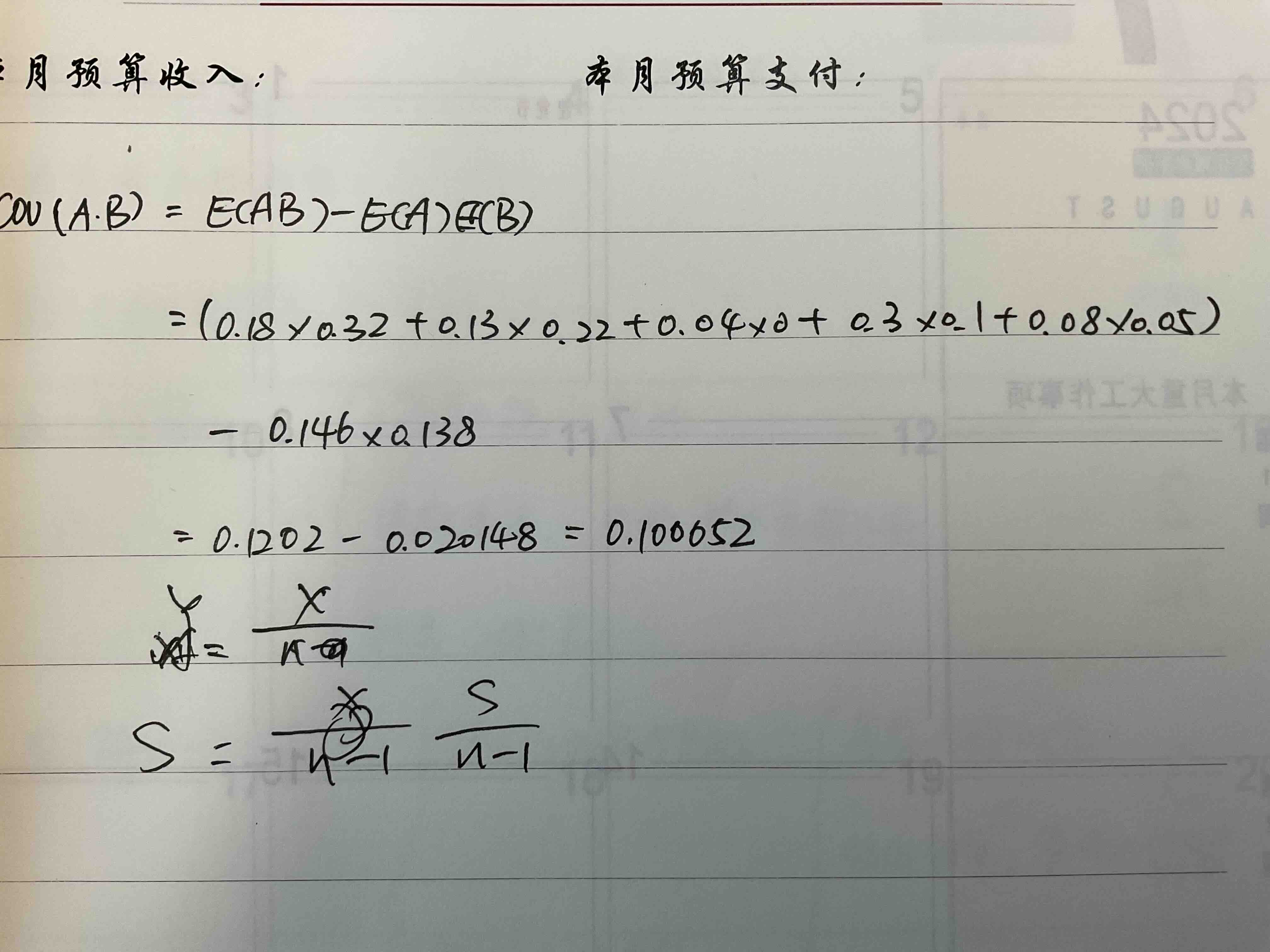

老师我用cov(A、B)=E(AB)- E(A)E(B)得出来是这个数字,就算用n/(n-1)调整也差距太远了,可以麻烦看看问题出在哪里吗