NO.PZ2025012202000017

问题如下:

How are insurers double exposed to climate risks?选项:

A.Increased insurance premiums and decreased investment returns

B.Liability from property and casualty insurance and re-pricing of assets

C.Decreased life insurance premiums and increased re-insurance premiums

解释:

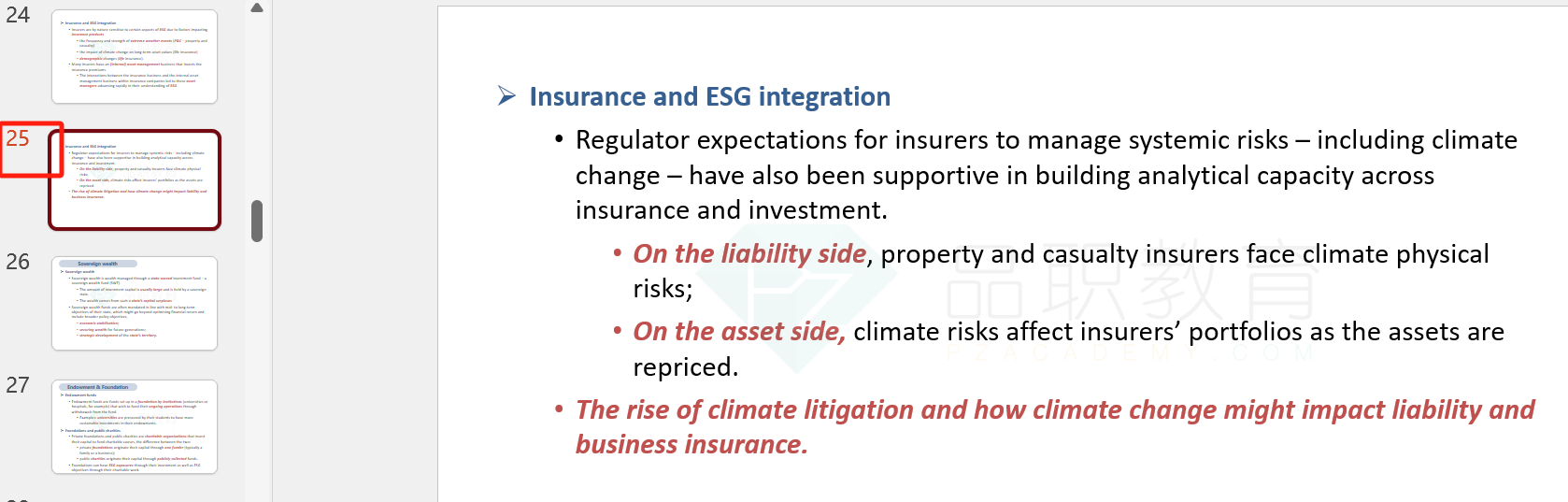

B is correct. Insurers are double exposed to climate risks because both sides of their balance sheet can be affected by these risks. On the liability side, property and casualty insurers face physical climate risks, such as increased frequency and severity of natural disasters. On the asset side, climate risks affect insurers’ portfolios as the assets are repriced.该题目体现在讲义的哪个部分,是讲义里的原话吗?