NO.PZ2023091701000078

问题如下:

Assume that portfolio daily returns are independently and identically normally distributed. A new quantitative analyst has been asked by the portfolio manager to calculate portfolio VaRs for 10-, 15-, 20-, and 25-day periods. The portfolio manager notices something amiss with the analyst’s calculations displayed below. Which one of following VaRs on this portfolio is inconsistent with the others?

选项:

A.VaR(10-day) = USD 316M B.VaR(15-day) = USD 465M C.VaR(20-day) = USD 537M D.VaR(25-day) = USD 600M解释:

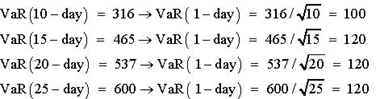

The calculations

follow. Calculate VaR(1-day) from each choice:

VaR(1-day) from A is different from those from other answers.