NO.PZ2023032701000018

问题如下:

Peters then asks the team to examine the growth opportunities of three Canadian stocks currently held in the portfolio. These stocks are listed in Exhibit 1. Peters believes that the stocks are fairly valued.

Based on Exhibit 1, the growth component of the leading P/E is largest for:

选项:

A.

ABTD

B.

BKKQ

C.

CPMN

解释:

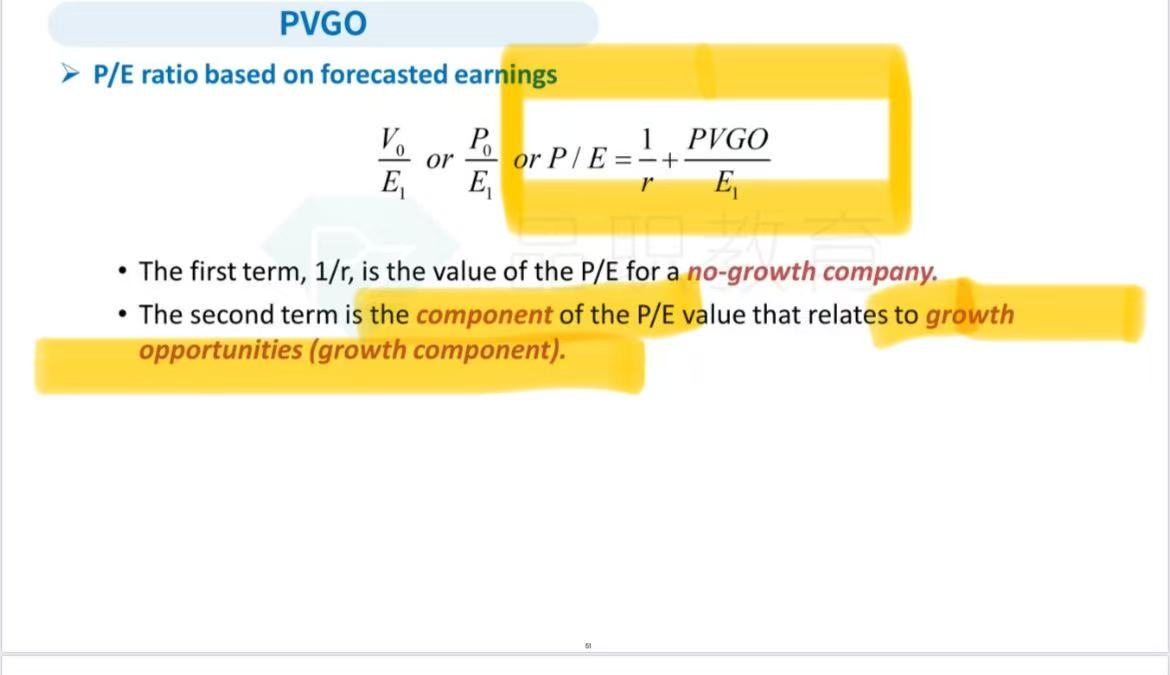

The leading P/E is calculated as follows:

P0/E1 = [1/r] + [PVGO/E1],

where, 1/r captures the no-growth component of P/E and PVGO/E1 captures the growth component of the P/E. PVGO is computed as follows:

PVGO (ABTD) = P0 – E1/r = 80.00 – [7.30/0.105] = C$10.48,

PVGO (BKKQ) = P0 – E1/r = 39.00 – [2.12/0.08] = C$12.50,

PVGO (CPMN) = P0 – E1/r = 27.39 – [1.90/0.12] = C$11.56,

where, P0 is the current price per share, E1 is the forecasted earnings per share, and r is the required rate of return.

The growth component of the P/E for each stock [PVGO/E1] is:

ABTD: 10.48/7.30 = 1.44×

BKKQ: 12.50/2.12 = 5.90×

CPMN: 11.56/1.90 = 6.08×

这种又细节,计算量也不小的题目确定会出吗..