NO.PZ2023091802000140

问题如下:

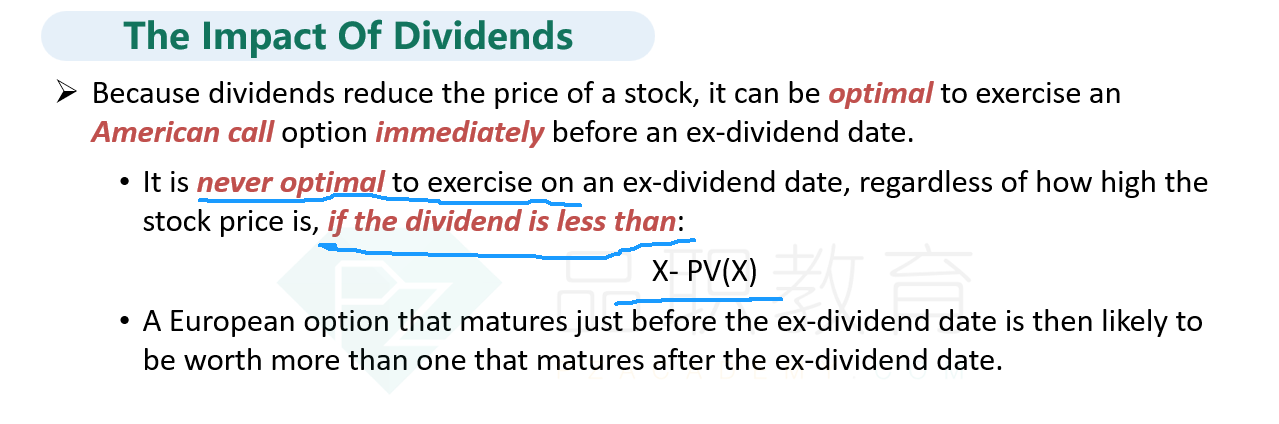

An investor holds an American call option on a dividend paying stock

with the following characteristics

Current stock price ,S=USD 50

Strike price, K=USD 50

Time to expiration ,T=2 mouths

A divided, D, of USD 1 per share has just been

announced ,with an ex-dividend date, t, of one month from now, Assuming the

risk-free rate, r, is 1.5% and the option stays at-the-money, is it optimal to

exercise the option right before the ex-dividend date?

选项:

A.

Yes, because S < K*exp(-r(T-t)) + D

B.

Yes, because D>K*(1-exp(-r(T-t)))

C.

No, because the call option is at-the-money ,and early exercise is only optimal when it is deep in-the-money

D.

No, because unlike an American put option, it is never optimal to exercise an American call option early.

解释:

请老师解释下这道题,谢谢