NO.PZ202301280200000601

问题如下:

The number of Euro Stoxx index futures needed to bring

the equity exposure of Smith’s portfolio to its target is closest to:

选项:

A.buy 263 Euro Stoxx Index Futures

sell 263 Euro Stoxx Index Futures

sell 313 Euro Stoxx Index Futures

解释:

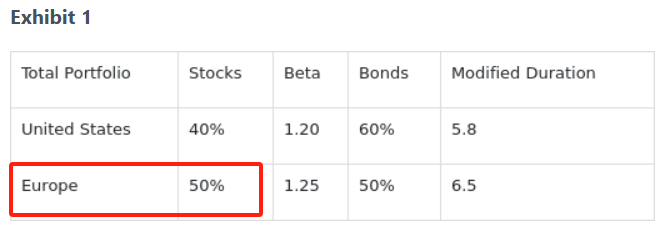

Smith’s Portfolio on 1 January Year 1

Smith’s European Portfolio on 1 January Year 2

To synthetically

rebalance EUR 3 million from the European equity portfolio with a beta of 1.25

using Euro Stoxx index futures contracts, Smith will need to sell:

where:

NSf =

number of Euro index futures contracts

βT =

target beta (0)

βS =

beta of synthetic cash (1.25) from the presumed sale of European Equity

βf =

futures beta (1.0)

S = market value

of equity position ($3,000,000)

fs =

Euro index futures contract price (1200)

m = multiplier

(10)

Number of futures

to sell = {(0 – 1.25) / 1.0} × {$3,000,000 / (1200 × 10)} = – 312.50 = – 313

(rounded)

Oliver Smith

should sell 313 Euro Stoxx index futures contracts.

结果算出来要sell的contract的数量比答案要很多……