NO.PZ201710200100000408

问题如下:

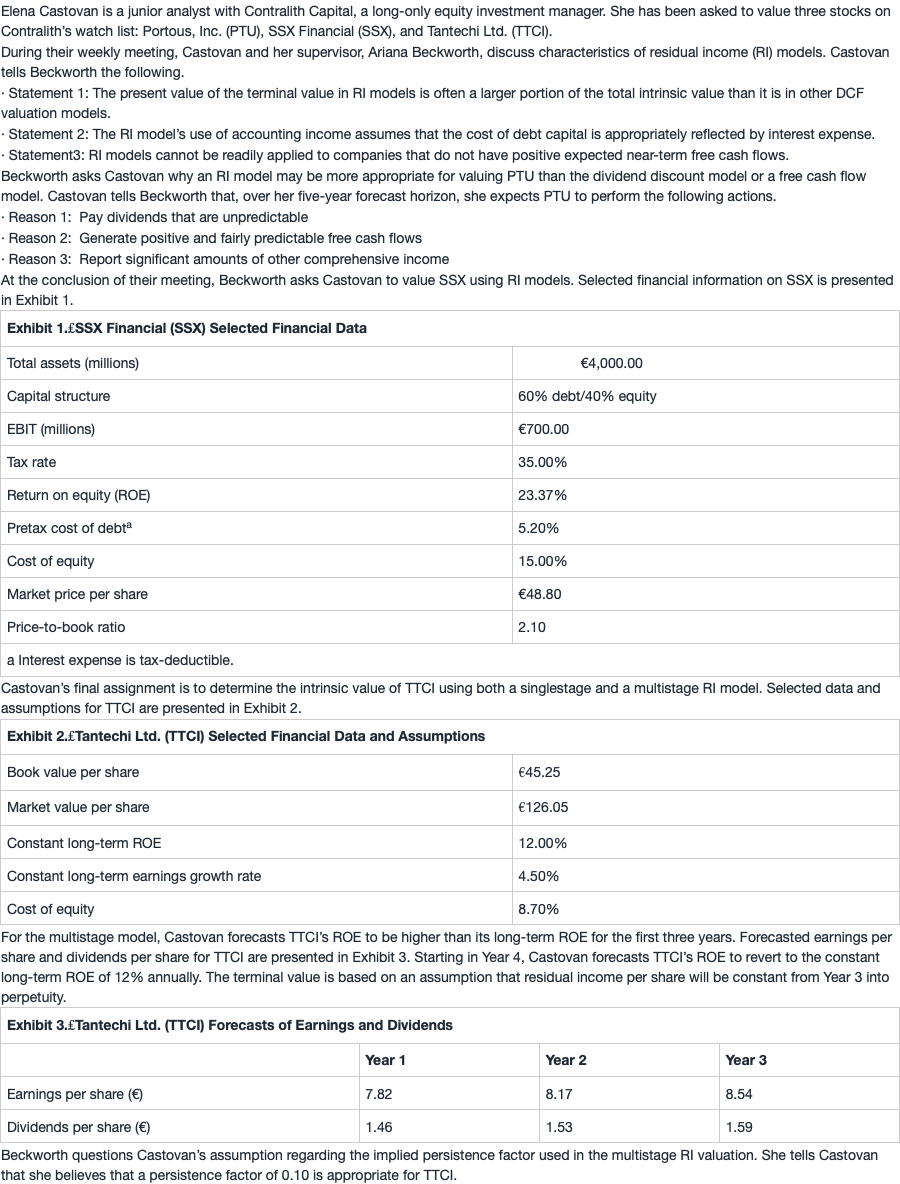

8. Based on Exhibits 2 and 3 and the multistage RI model, Castovan should estimate the intrinsic value of TTCI to be closest to:

选项:

A.€54.88.

B.€83.01.

C.€85.71.

解释:

C is correct.

Residual income per share for the next three years is calculated as follows.

Because Castovan forecasts that residual income per share will be constant into perpetuity, equal to Year 3 residual income per share, the present value of the terminal value is calculated using a persistence factor of 1.

Present value of terminal value =

= =33.78

So, the intrinsic value of TTCI is then calculated as follows.

V0=\frac{45.25+3.88/1.087+3.68/(1.087)^2+33.78}=85.71

老师 先用第三年的RI=3.47除以r,得到第四年年初的value=39.885 , 然后CF1=3.88,CF2=3.68,CF3=3.47+39.885 用r=8.7%折现,再加BV0 ,这样算对吗,怎么没有答案?