NO.PZ2024021801000003

问题如下:

A drawback of ESG index-based investment strategies is that they:选项:

A.focus only on environmental factors. B.cannot accommodate factor-based investing styles. C.rely on established datasets for construction that lack comparability and regional breadth.解释:

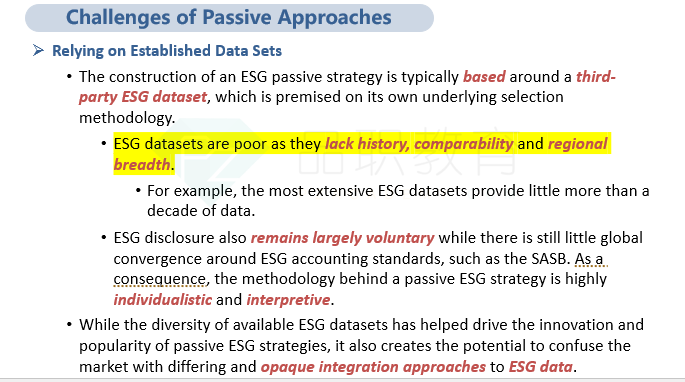

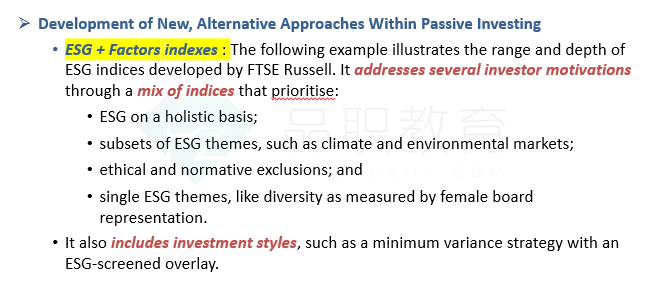

A. Incorrect because FTSE Russell have developed a range of indexes including single ESG themes, such as diversity as measured by female board representation.

B. Incorrect because the wider availability of ESG data and greater investor interest in responsible investment have also led to the development of new, alternative approaches in index-based investing. Single-factor ESG strategies (smart beta and beta plus) provide investors a means to weight an index toward a style factor.

C. Correct because ESG datasets lack history, comparability, and regional breadth. ESG disclosure also remains largely voluntary, and there is still little global convergence around ESG reporting standards.

其余两个答案为什么不对,以及是在讲义的哪一页?谢谢