NO.PZ2022010501000005

问题如下:

A European equity composite contains three portfolios whose cash flow weighting factors are as follows.

A Calculate the returns of Portfolio A, Portfolio B, and Portfolio C for the month of August using Modified Dietz formula.

B Calculate the August composite return by asset-weighting the individual portfolio returns using beginning-of- period values.

C Calculate the August composite return by asset- weighting the individual portfolio returns using a method that reflects both beginning-of-period values and external cash flows.

选项:

解释:

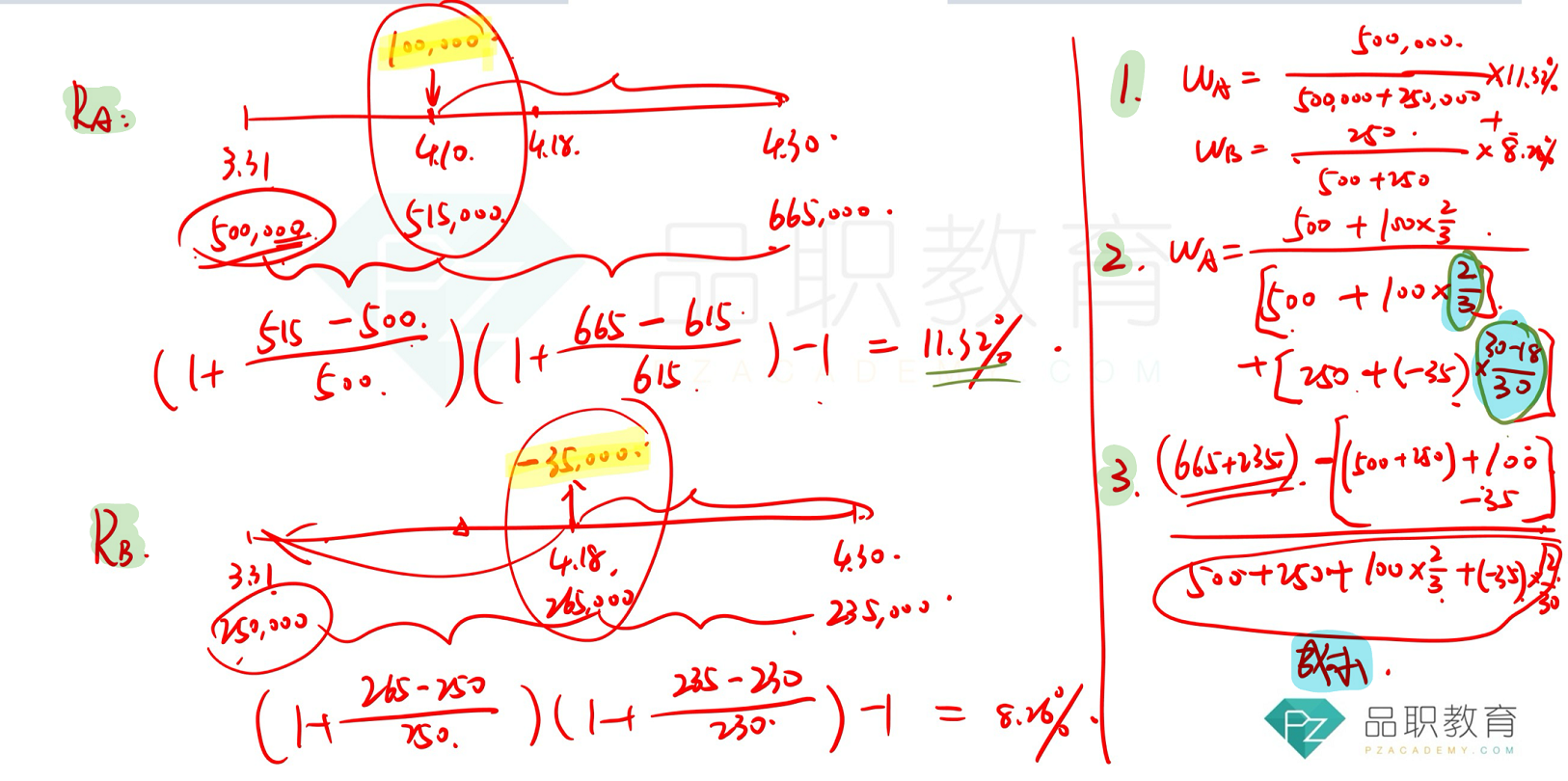

A Portfolio returns:

B To calculate the composite return based on beginning assets, first determine the percentage of beginning composite assets represented by each portfolio; then determine the weighted-average return for the month:

Beginning composite assets = 74.9 + 127.6 + 110.4 = 312.9

Portfolio A = 74.9/312.9 = 0.239 = 23.9%

Portfolio B = 127.6/312.9 = 0.408 = 40.8%

Portfolio C = 110.4/312.9 = 0.353 = 35.3%

C To calculate the composite return based on beginning assets plus cash flows, first use the denominator of the Modified Dietz formula to determine the percentage of total beginning assets plus weighted cash flows represented by each portfolio, and then calculate the weighted-average return:

Beginning composite assets + Weighted cash flows = [74.9 + (7.5 × 0.613)] + [127.6 + (−15 × 0.742) + (−5 × 0.387)] + [110.4 + (15 × 0.387)] = 79.5 + 114.535 + 116.205 = 310.24

Portfolio A = 79.5/310.24 = 0.256 = 25.6%

Portfolio B = 114.535/310.24 = 0.369 = 36.9%

Portfolio C = 116.205/310.24 = 0.375 = 37.5%

The Aggregate Return method is calculated by summing beginning assets and intra- period external cash flows, treating the entire composite as though it were a single portfolio and then computing the return directly with the Modified Dietz formula.

在算composite的 asset weighting return时,对于所用到的composite中包含的portfolio的return,这题的B和C,直接用了A算出来的modified dietz的return,但是老师上课就是用了Sub-period的计算方式,请问为何这道题BC两问默认使用modified dietz方法呢?是因为sub-Period计算方式缺条件吗?