NO.PZ2019042401000030

问题如下:

Which of the following statement about the evolution of the hedge fund industry is incorrect?

选项:

A.

During 1987-1996, hedge funds easily outperformed the SNP index.

B.

After the collapse of long term capital management in fall of 1998,reporting within the hedge fund industry became more regulated than mutual funds.

C.

During the time period following the dot-com collapse, hedge funds outperformed the S&P 500 with a lower standard deviation, which attracted institutional investment.

D.

It was due to the involvement of institutional investors that problems related to performance measurement and reporting were minimized.

解释:

B is correct.

考点:the evolution of the hedge fund industry

解析:

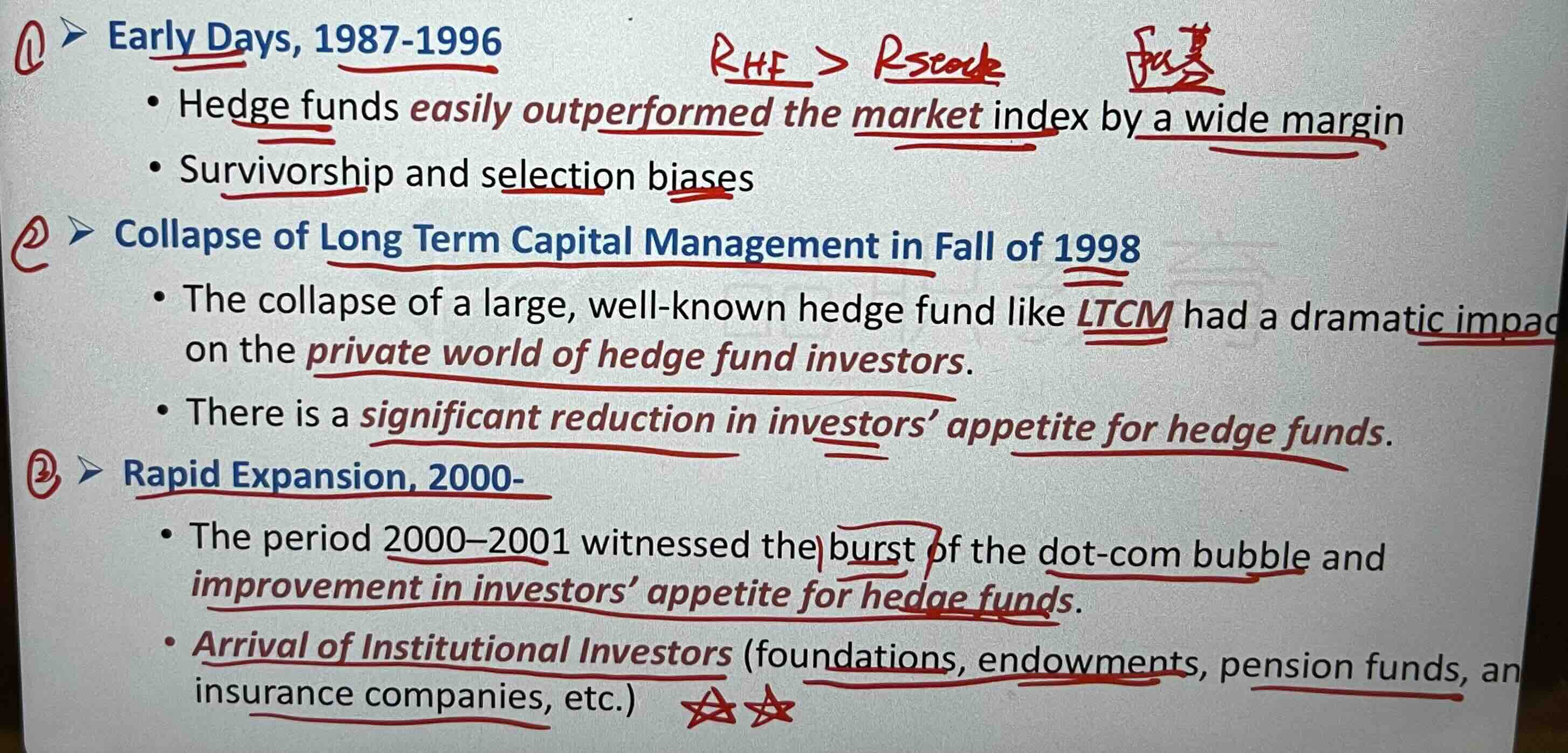

1987-1996 年间,由于 survivorship and selection biases 的存在,hedge fund 的表现是优于SNP指数,于是吸引了很多投资者。A选项正确。而随着98年长期资本管理公司的倒闭,人们开始意识到之前衡量对冲基金的风险的要素是不够的,但是对冲基金的监管并没有比mutual fund 更严。B选项错误。随着互联网泡沫的破灭,对冲基金的表现优于标普500指数,因此吸引了大量的机构投资者,C选项正确。由于机构投资者的加入,他们对对冲基金的业绩质量、管理流程要求更为严格,所以对冲基金之前存在的业绩计量和报告的问题得到了减少。D选项正确。

老师好,从课件来看,吸引大量机构投资者应该是发生在互联网泡沫之前吧?