NO.PZ2019042401000054

问题如下:

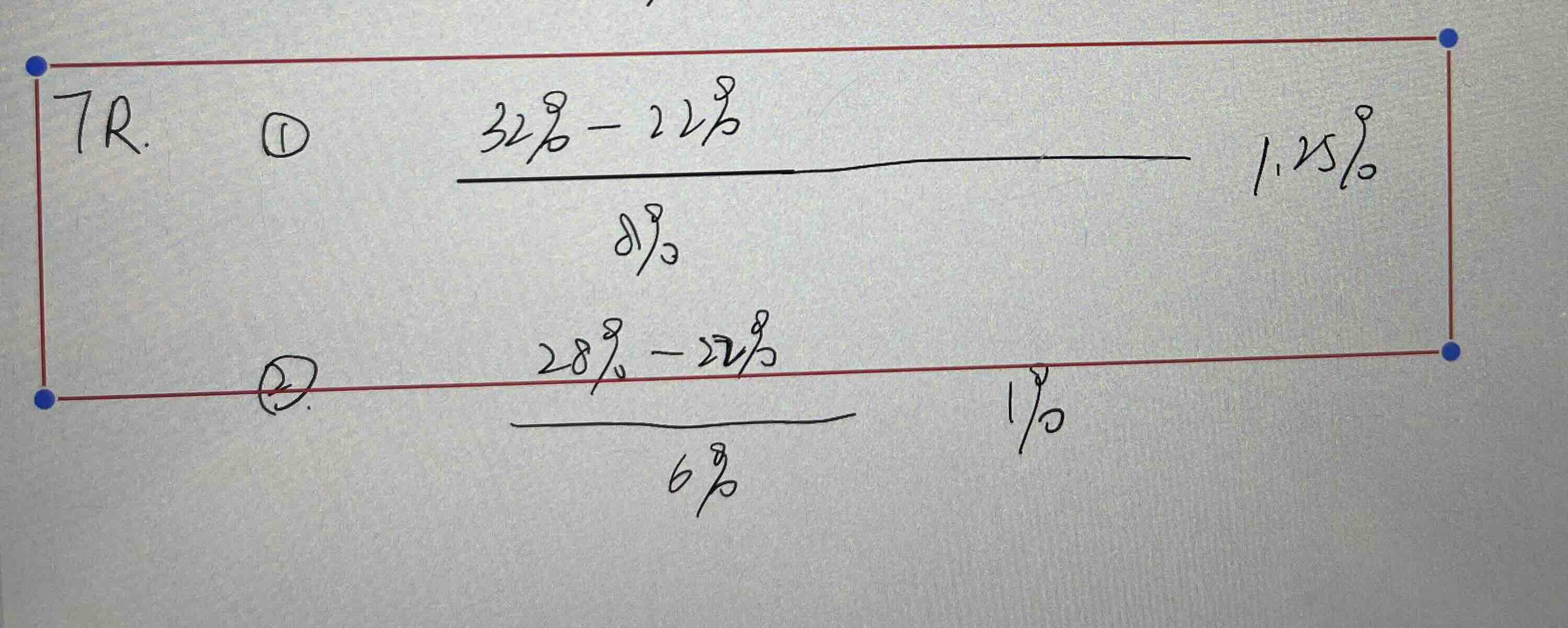

An investor is comparing the performances of two portfolio managers who have been allocated an equal amount of investment funds. The managers apply the same strategy with the same constraints, and their portfolios are not diversified. The investor gathers the following data about the two managers and the market index:

The risk-free rate of interest is 3%. Which of the following is an appropriate measure to use and the correct conclusion to reach when comparing the performances of the two managers?

选项:

A.

The Modigliani-squared measure, which shows that Manager 2 outperforms Manager 1 by 2%

B.

The Modigliani-squared measure, which shows that Manager 1 outperforms Manager 2 by 4%

C.

Treynor’s measure, which shows that Manager 1 outperforms Manager 2 by 6%

D.

Treynor’s measure, which shows that Manager 2 outperforms Manager 1 by 6%

解释:

A is correct. When comparing the performances of portfolios that are not fully diversified, the appropriate measure to use is Sharpe or M2; Sharpe to rank the performance of the portfolios, M2 to calculate by how much one portfolio outperforms/underperforms the market or the other portfolio. Treynor ratio is appropriate to use when we are comparing many portfolios to form an overall portfolio. Because the number of portfolios combined is high, nonsystematic risk is largely diversified away and beta (rather than standard deviation) can be used to measure risk. This is not the case here. The investor in the question is interested in total risk.

B, C, and D are incorrect.

老师好,两个TR错在哪里了呢?