NO.PZ202304050100004801

问题如下:

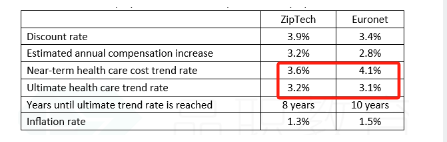

(1) Which of the assumptions in Exhibit 2 would most likely result in a lower reported post-employment benefit obligation for Euronet as compared with ZipTech?

选项:

A.

Near-term health care trend rate

B.

Ultimate health care cost trend rate

C.

Years until the ultimate trend rate is reached

解释:

B is correct. Other things equal, a lower assumed ultimate health care trend rate would result in a lower benefit obligation and a lower periodic cost. Euronet’s 3.1% rate is lower than ZipTech’s 3.2% rate. A higher assumed near-term health care cost trend rate or a greater number of years until the ultimate trend rate is reached would result in a higher benefit obligation and a higher periodic cost. Both of these assumptions are higher for Euronet.

A is incorrect. Other things equal, a higher assumed near-term health care cost trend rate would result in a higher benefit obligation and a higher periodic cost. Euronet’s 4.1% rate is higher than ZipTech’s 3.6% rate.

C is incorrect. Other things equal, a greater assumed number of years until the ultimate trend rate is reached would result in a higher benefit obligation and a higher periodic cost. Euronet’s 10 years are greater than ZipTech’s 8 years.

我不理解为什么是到达年限越长是费率下降的,ultimate trend rate不是估算是正数,指的是持续上升的吗?为什么C的解析说是不断下降,下降的时间越长债务越大?