NO.PZ2023040601000108

问题如下:

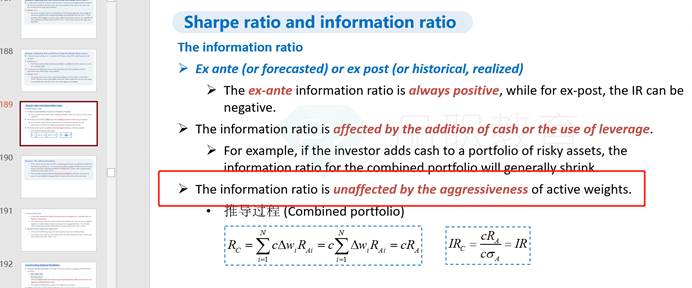

Martinez asks Singh about the possible effects on the portfolio’s information ratio if cash were added to the diversified asset portfolio or if the aggressiveness of the portfolio’s active weights were increased. Singh responds with two statements:

- Statements1: Adding cash to the portfolio would change the portfolio’s information ratio.

- Statements2: Increasing the aggressiveness of active weights would not change the portfolio’s information ratio.

选项:

A.

Only Statement 1

B.

Only Statement 2

C.

Both Statement 1 and Statement 2

解释:

The information ratio for a portfolio of risky assets will generally shrink if cash is added to the portfolio. Because the diversified asset portfolio is an unconstrained portfolio, its information ratio would be unaffected by an increase in the aggressiveness of active weights.

改变weight会影响optimal amount of risk, 从而影响IR啊, 因为它等于(IR/SR)*Bmk risk