NO.PZ2023040601000097

问题如下:

Wei Liu makes two statements about active portfolio management:

- Statement 1: The “active return” of an actively managed portfolio is the difference between the portfolio’s return and the return on the benchmark portfolio, and is equal to the managed portfolio’s alpha.

- Statement 2: The active weights are the differences in the managed portfolio’s weights and the benchmark’s weights.

选项:

A.

Only Statement 1 is correct.

B.

Only Statement 2 is correct.

C.

Both statements are correct.

解释:

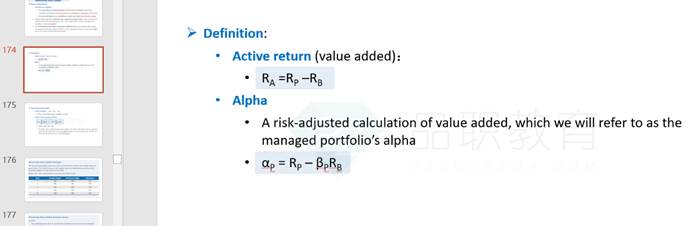

Although the first part of Statement 1 is correct (active return, or value added, equals the difference between the managed portfolio return and the benchmark return), active return is not the same as alpha. In other words, RA=RP-RB, while

Statement 2 correctly defines active weights.

能解释一下这里的pf的alpha吗