NO.PZ2019042401000057

问题如下:

An investment fund uses risk budgeting as part of its risk management process. Risk is calculated and monitored using delta-normal VaR at the 99% confidence level. The fund’s total principal of EUR 100 million is invested across four asset classes comprised of European stocks, non-European stocks, European bonds, and non-European bonds. The total volatility profile of the fund is maintained at 10%. Information on the four asset classes is given below:

What is the sum of the risk budgets that should be allocated to the four asset classes?

选项:

A.

EUR 22.12 million

B.

EUR 11.64 million

C.

EUR 38.86 million

D.

EUR 100.0 million

解释:

A is correct:

B is incorrect. EUR 11.64 million is the VaR of the fund: 100 x 5% x 2.33 = 11.64

C is incorrect. EUR 38.86 million is found when volatilities are multiplied by EUR 100 million and added together.

D is incorrect. EUR 100 million is the principal amount.

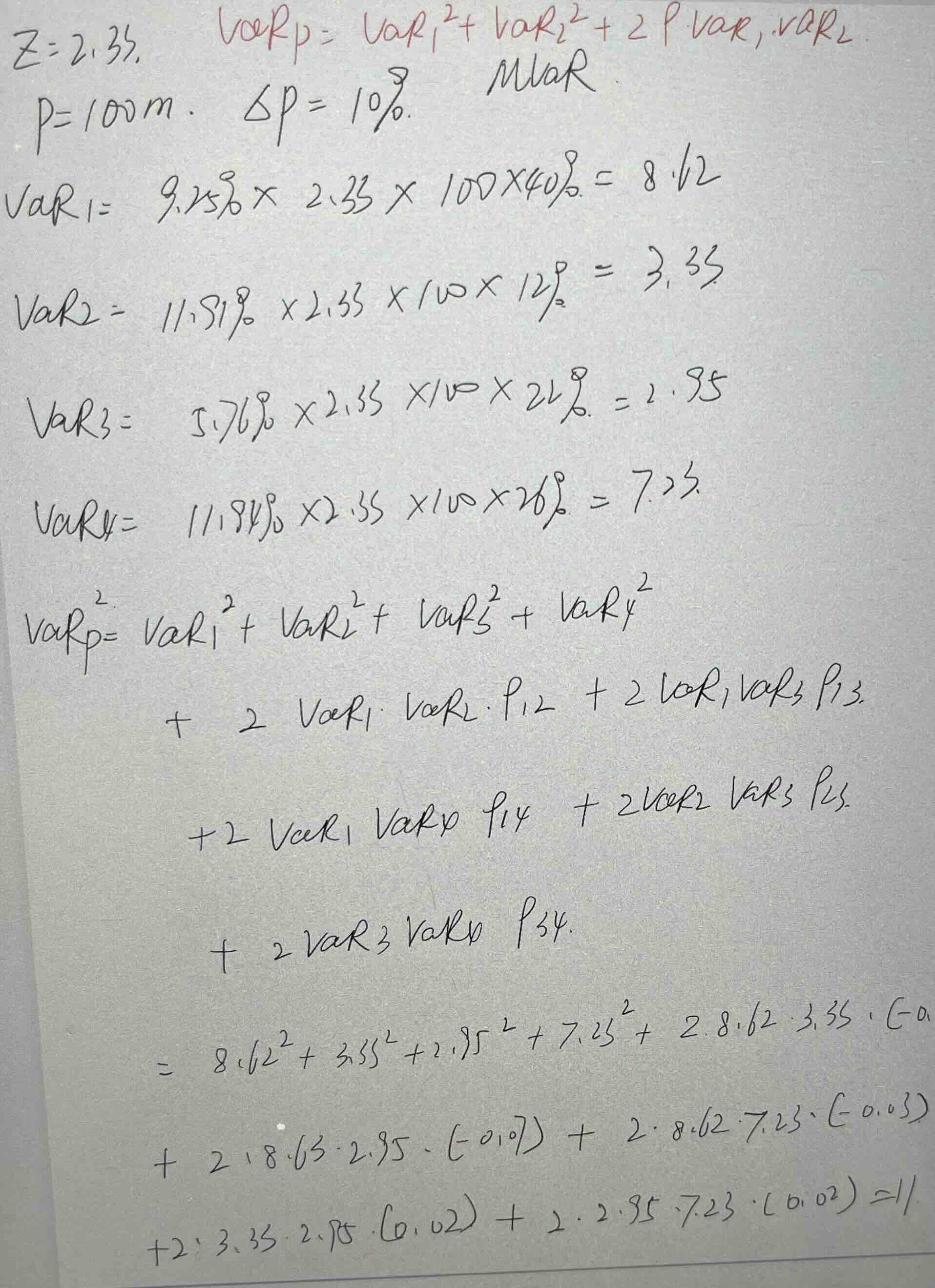

为什么不考虑p?

课程里讲的portfolio的VaR不应该是红色公式吗?

答案就是把四个资产的VaR简单相加。

哪里计算错了呢?