NO.PZ2019042401000061

问题如下:

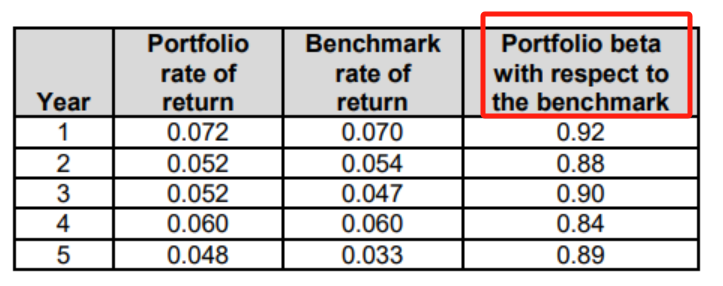

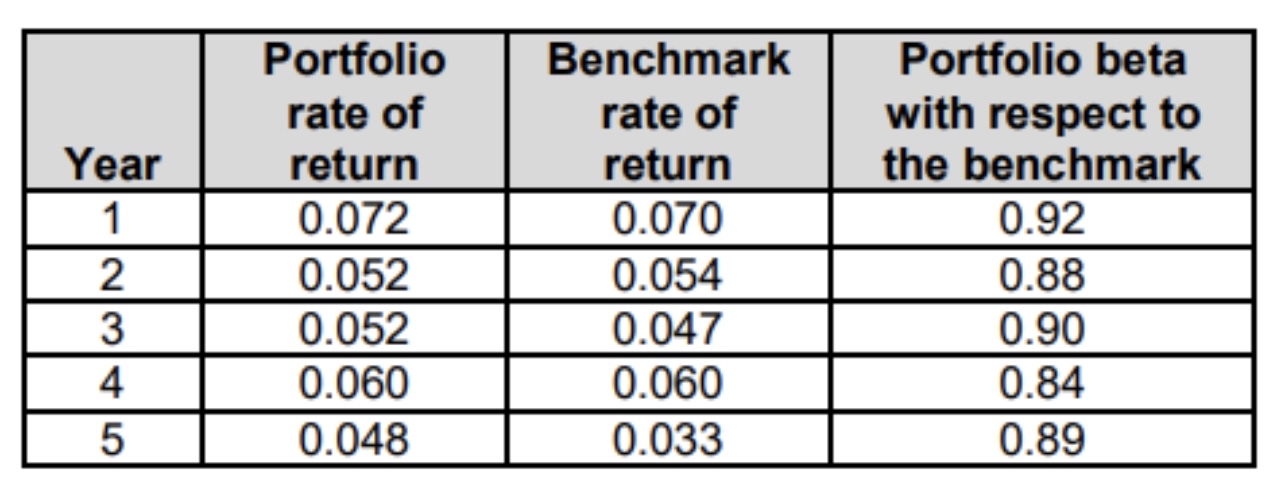

A portfolio manager at a hedge fund manages an equity portfolio that is benchmarked to an index. The information on the performance of the portfolio and the benchmark over the last 5 years is provided below:

What is the approximate value of the manager’s information ratio?

选项:

A.

0.60

B.

0.20

C.

0.90

D.

1.08

解释:

IR = Average excess returns / Std dev of excess returns (IR = Alpha / Tracking error) Average excess returns: 0.0040 Std dev of excess returns: 0.0067 IR = 0.59

A is incorrect. It is found by dividing portfolio returns by benchmark returns and then taking the standard deviation of these ratios.

C is incorrect. It is the average of betas.

D is incorrect. It is found by dividing average portfolio returns by average benchmark returns.

老师好,第四列第一行的英文是什么意思呢?这题用不上吧?