NO.PZ2019011002000004

问题如下:

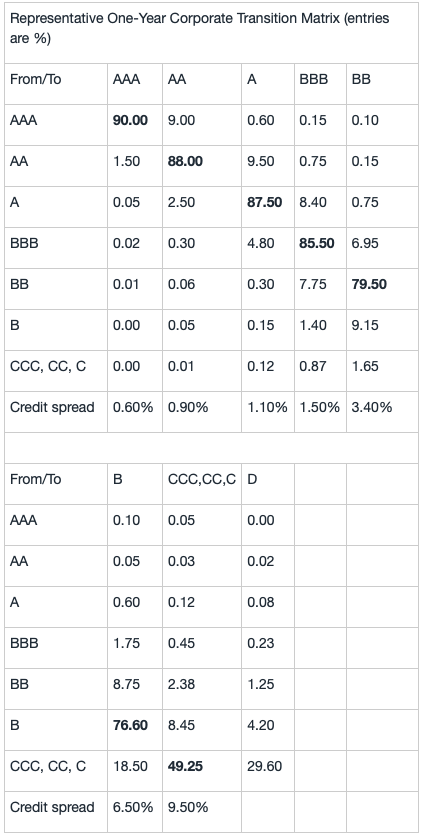

Bond C is a 5-year corporate bond rated at AA. The table below shows the probabilities of a particular rating transitioning to another over the course of the following year.

Bond C will have a modified duration of 3.22 at the end of the year. According to the information above and assuming no default, how should the analyst adjust the bond’s yield to maturity (YTM) to assess the expected return on the bond over the next year?

选项:

A.Add 0.091% to YTM

B.Subtract 0.091% from YTM

C.Subtract 0.120% from YTM

解释:

B is correct

解析:

考点:考察对Transition matrixes的理解和使用

表格最后一行显示了每一个评级下的Credit spread;由题干信息已知债券的Modified duration为3.22;

则从AA变动为AAA,债券价格的变动为:

-3.22×(0.60%-0.90%)=0.9660%

从AA变动为A,债券价格的变动为:

-3.22×(1.10%-0.90%)=-0.6440%

从AA变动为BBB,债券价格的变动为:

-3.22×(1.50%-0.90%)=-1.9320%

从AA变动为BB,债券价格的变动为:

-3.22×(3.40%-0.90%)=-8.050%

从AA变动为B,债券价格的变动为:

-3.22×(6.50%-0.90%)=-18.0320%

从AA变动为CCC,CC,C,债券价格的变动为:

-3.22×(9.50%-0.90%)=-27.69%

题干中的表格给出了AA级向每一个级别变动的概率,因此我们可以用概率乘以对应的债券价格变动:

0.015×0.966%+0.8800×0%+0.0950×(-0.644%)

+0.0075×(-1.9320%)+0.0015×(-8.050%)

+0.0005×(-18.0320%)+0.0003×(-27.69%)=-0.091%

则假设在没有违约的情况下,下一年的预期收益为YTM减去0.091%。

为什么要选AA级别?可以选其他级别比如aaa或者a进行计算吗?