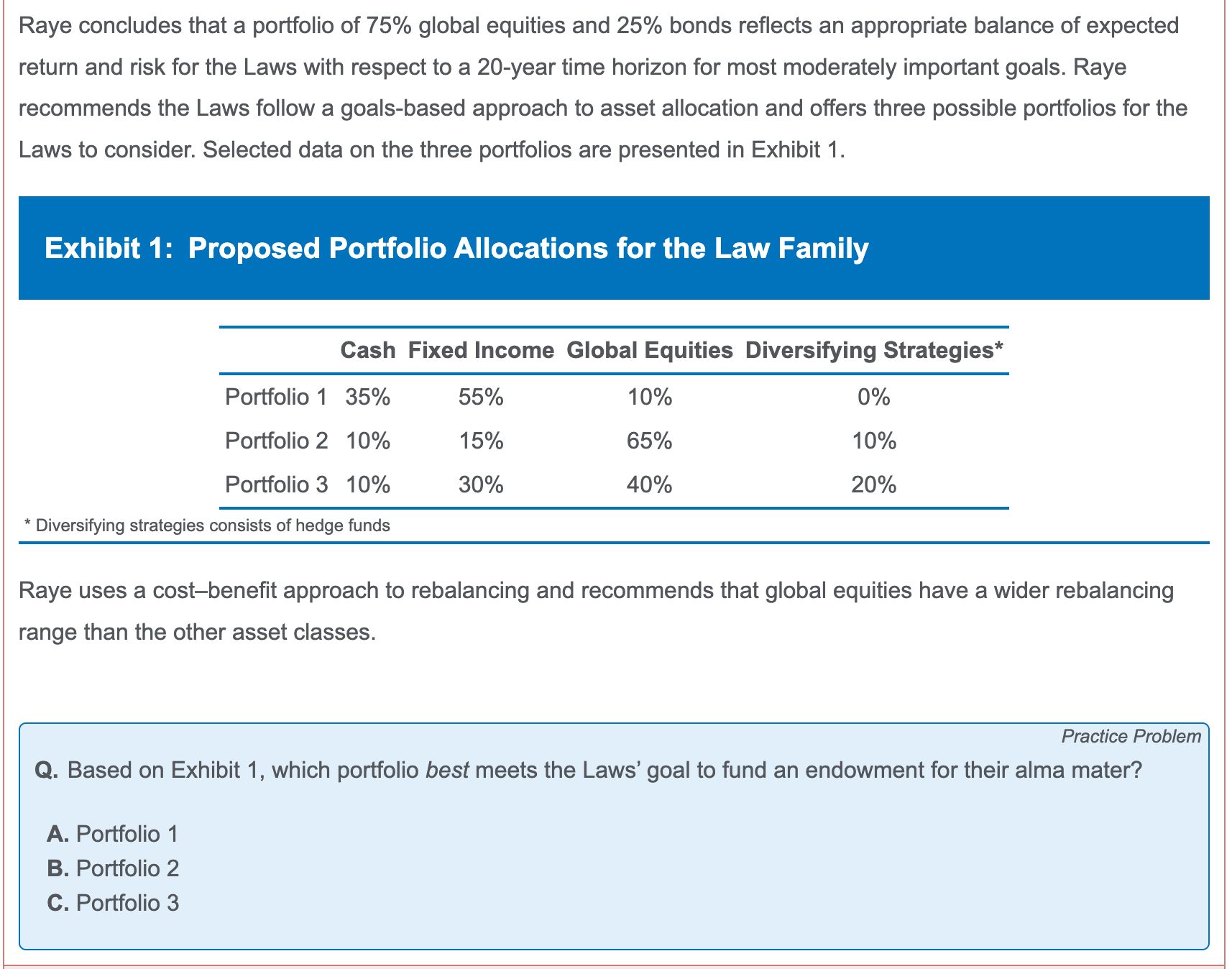

前面还有一句:The Laws tell Raye they want a high probability of success funding the endowment.

答案是equity占比最多的portfolio 2, 原因是:Although slightly more conservative than the 75/25 global equity/bond mix, Portfolio 2 has a greater growth emphasis compared with Portfolios 1 and 3。

但是不是要high probability of success funding 吗,那除了growth之外,underfunding risk也该考虑吧。第三个cash+FI的占比更高,而且还有diversified strategy,为什么不选呢?