NO.PZ201812170100000106

问题如下:

Based on Exhibit 1, Smith should conclude that the insurer with the most efficient underwriting operation is:

选项:

A.

Insurer A.

B.

Insurer B.

C.

Insurer C.

解释:

C is correct.

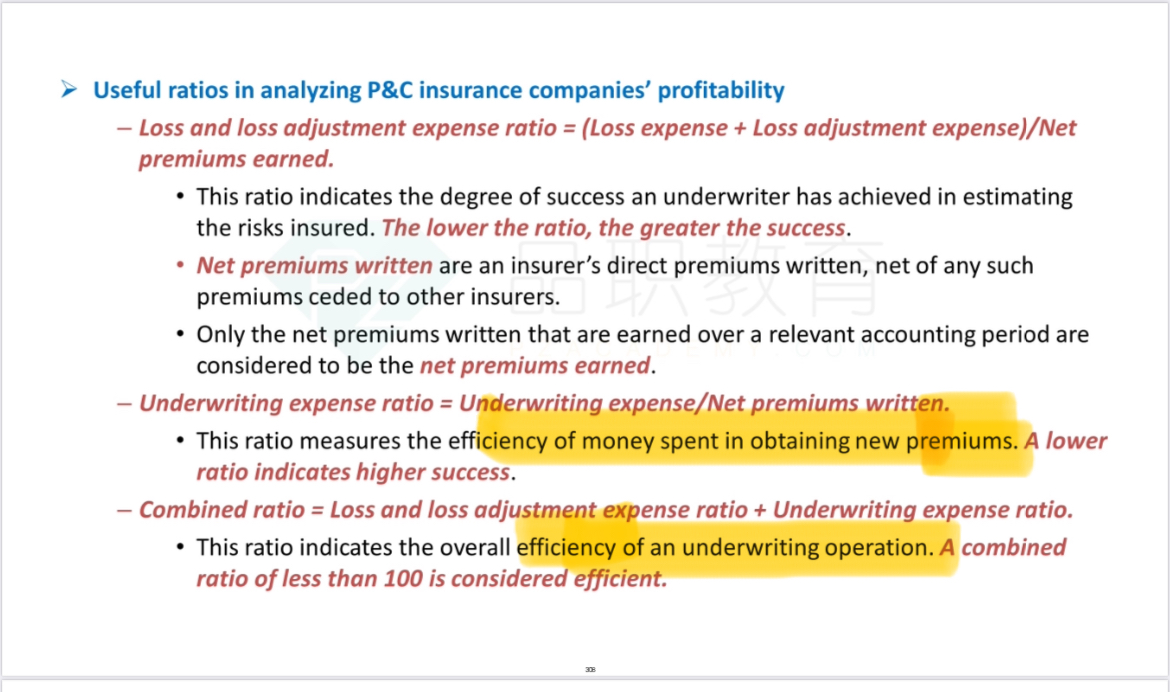

The combined ratio, which is the sum of the underwriting expense ratio and the loss and loss adjustment expense ratio, is a measure of the efficiency of an underwriting operation. A combined ratio of less than 100% is considered efficient; a combined ratio greater than 100% indicates an underwriting loss. Insurer C is the only insurer that has a combined ratio less than 100%.

解析:

考点:Analysis of Financial Institutions - An Insurance Company - Property and Casualty Insurance Companies - Earnings Characteristics

题目问哪家公司的 underwriting operation 承保业务效率最高。首先明确需要看的指标是 the combined ratio ( underwriting expense ratio + loss and loss adjustment expense ratio)

其次,combined ratio 越低越好;低于 100% 的 combined ratio 代表有效率,大于 100% 的 combined ratio 说明收到的保费无法覆盖运营成本及理赔支出,说明保险公司的业务做的不好,在赔钱。

所以根据数据,Insurer C 的 combined ratio 最低,选 C

这里明明要看underwriting的运营效率却用combined ratio看,第四小问主人公却也说了efficiency of spending on new premium这类的话,意思接近却要用underwriting expense ratio。我就想知道这会是cfa的出题方向吗?很难评