NO.PZ2023120801000066

问题如下:

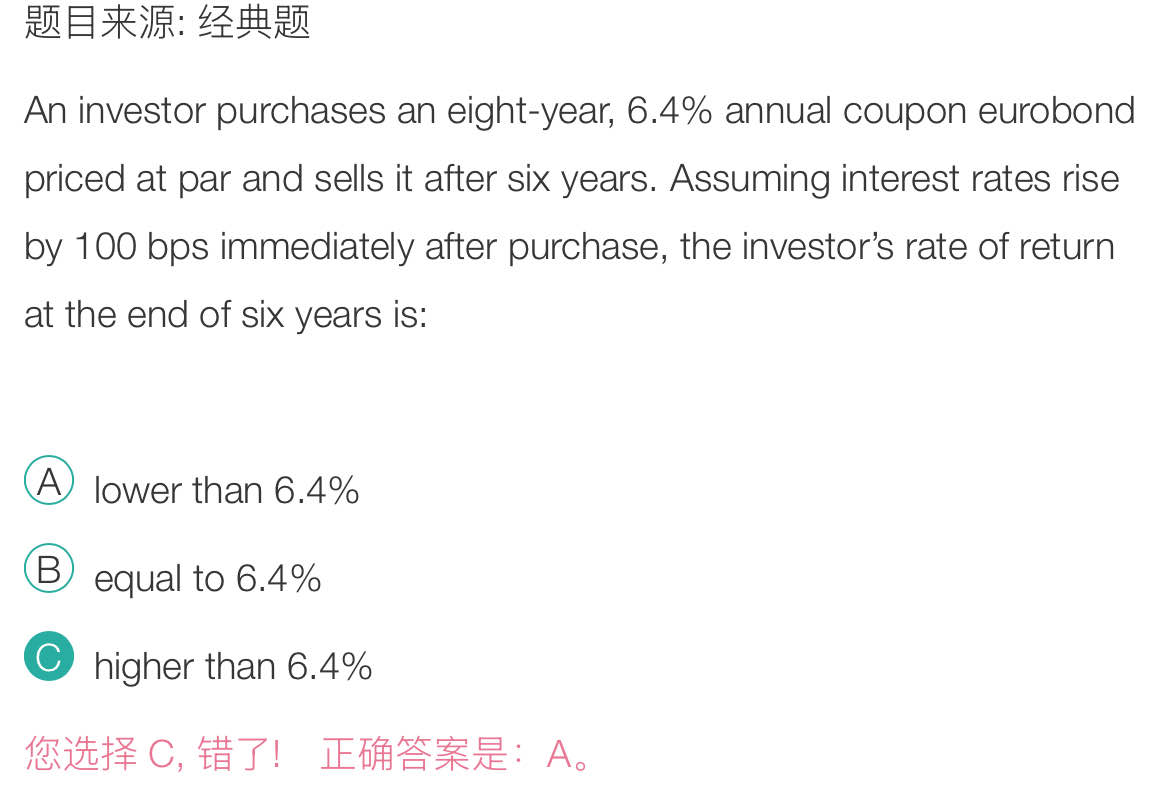

An investor purchases an eight-year, 6.4% annual coupon eurobond priced at par and sells it after six years. Assuming interest rates rise by 100 bps immediately after purchase, the investor’s rate of return at the end of six years is:

选项:

A.

lower than 6.4%

B.

equal to 6.4%

C.

higher than 6.4%

解释:

Correct Answer: A

The future value of reinvested coupon interest is:

N=6, PV=0, PMT=6.4, I/Y=7.4, CPT→FV=46.245

The sale price of the bond at the end of six years is:

N=2, FV=100, PMT=6.4, I/Y=7.4, CPT→PV=98.202

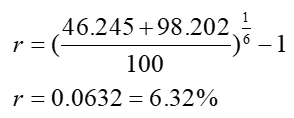

which results in a six-year horizon yield of 6.32%, which is lower than 6.40%:

老师想问一下,这道题的maturity是8年,他说在六年的时候卖,那说明要reinvest coupon六年,然后price effect只有两年,那么r上升的时候,reinvestment income更多,说明这个effect大于price effect带来的下降的影响,那整体的影响offset一下,total return不是上升么,那为什么realized return不大于6.4%呢?